Where was the alpha - Quick takes

Welcome back!

This week, we will commence a series to retrospectively analyze the factors that have impacted the markets over the past month. Our focus will be on successful trades and identifying areas where additional returns materialized, compared to the S&P Equal Weight ETF.

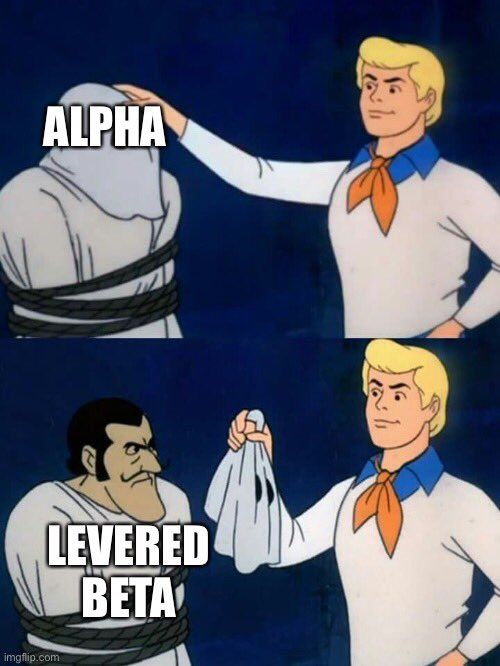

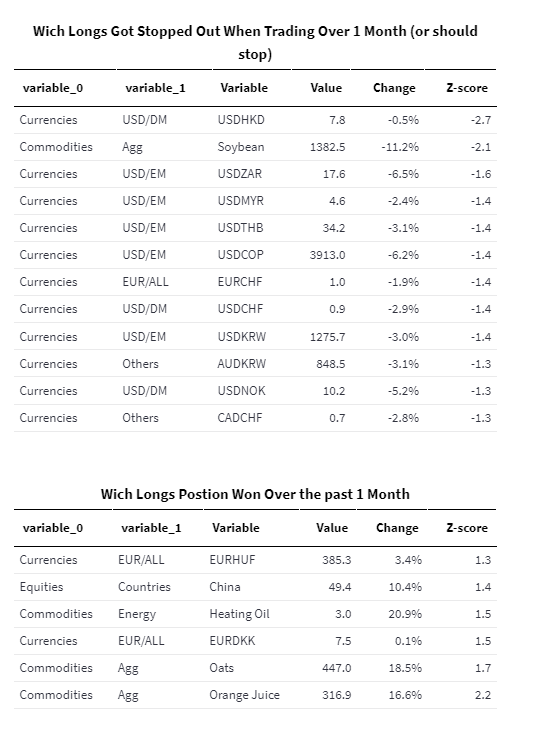

Upon taking an overall view, it is evident that significant deviations occur every month in commodities and currencies, as highlighted in the chart below.

All the analyses will be based on apples-to-apple comparisons, here is a reminder to always size your positions right; I'm building a tool for that, soon available here!

Look at the volatility of each asset, and apply your tilts where youbelieve you havee ana edge!

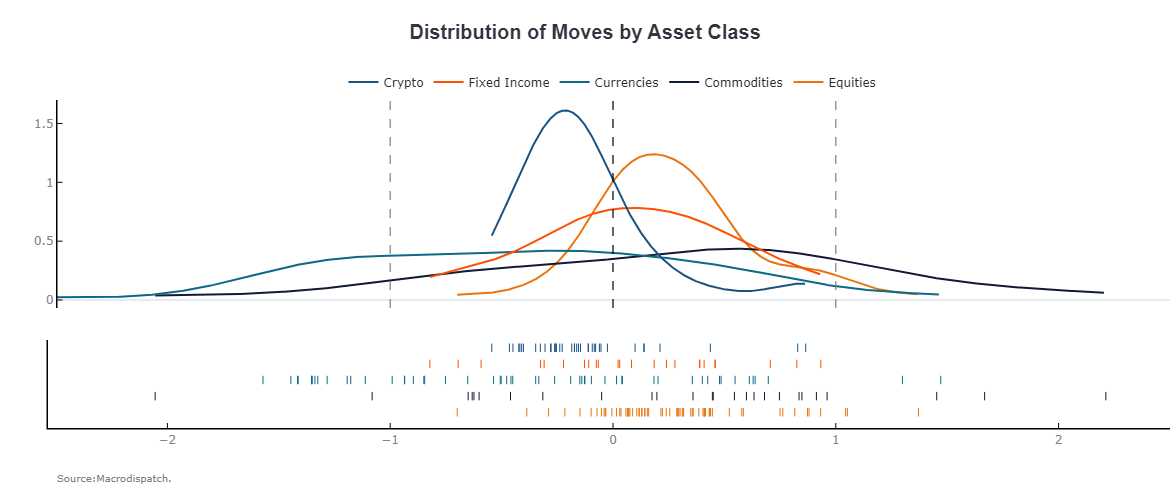

Zooming in, we can observe the FX part of the Equation where the main narrative has been of dollar weakness combined with Asian currency's Strength; both the KRW, HKD, and JPY have had strong moves against the EUR and USD.

Notice USD had Zero positive vol-adjusted moves against DM! Betting Long Dollar this month defintly was a pain.

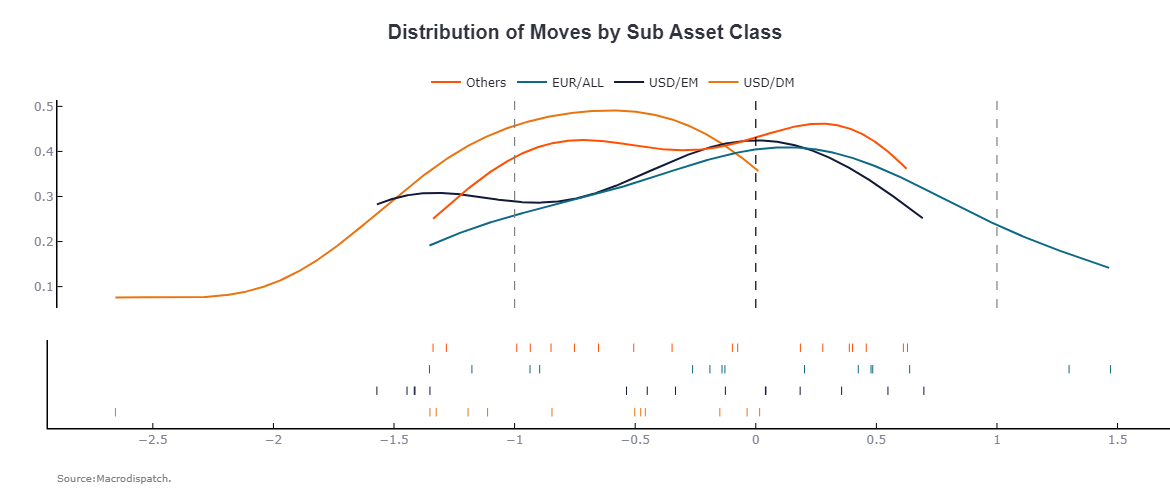

Commodities also had pretty volatile Tails, with agricultural things and Energy responsible for the most significant vol-adjusted moves.

As we observed from the high-level distribution of outcomes charts above, the big movers this month were in commodities and FX.

The table below confirms that the only equity that had over one sigma move was China,

Reopening for longer, it is!

On the short side, we can observe that if you touched a long dollar position you were likely stopped out somewhere along the month!

After Yellne went to China for a quick visit, the main move of the month was a 2.7 z-score move assuming the top of the leaderboard; here, we can also flag the importance of normalizing your data, it's not perfect, but it helps flag how important this -0.5% change is giving the monthly timeframe.

It's the small stuff like that that matters, and if you flagged that possibility beforehand and sized it correctly based on underlying vol, you did well. Being on the short side of this trade defintly impacted your P&L.

If you like this newsletter, and this type of content, please consider subscribing and sharing it or forwarding it to others interested.

I'm also on Twitter. @macrodispatch if you want to reach out.

Member discussion