Updates - Primary Dealers and Rates regime

Welcome back to this edition of macrodispatch!

in this article will go trough primary dealers positioning, and some a little rates regime tool i put together wher you can have acess to the tool and the source code, a present to start of 2025.

Primary Dealers' Net Bond Positioning Continues to Climb Higher

What are the major contributors?

Primarily the 3-6Y and 7-10Y maturities.

With Bessent and Miran having serving in the Trump administration, its important to point out both argued that the Weighted Average Maturity (WAM) of U.S. debt is too low.

Bessent has advocated for the U.S. to introduce ultra-long-duration debt (50-100 years), conditional on implementing stronger fiscal discipline within the U.S. government.

Similarly, Miran authored a detailed paper arguing for higher net issuance of longer-duration bonds and an overall increase in WAM, and argued the yellen treasury was doing Active Treasury Issuance (full article on that here) , wich also got some heavy critics from high profile experts as is the case of darrel duffie coments on the paper (but wont get that much into it not the focus of the post).

That said, judging by primary dealers' balance sheet positions, the openness to holding longer duration might face greater challenges than anticipated. a potencial Increases in duration in the next QRA could impose even more strain on dealers' balance sheets.

Month end spreads have been surging in the past 6 months, espeacilly the GCF, indicating bid for liquidity from small dealers.

We also we need to take into account from the latest dealer survey, they expect quantitative tightening (QT) to stop in the first half of 2025, potentially reducing the marginal supply of bonds observed by markets. (for now the fed has not introduced guindance on the topics, but the dealers expectations are set).

At last, keep in mind that funding markets are currently moving toward mandatory central clearing of treasury securities, which could add further constraints due to higher haircuts compared to the non-centrally cleared bilateral market and continue to push growth on the sponsored repo segment more on that on the next update.

On reserves side of things Overnight RRP is close to 100 billion and 2025 looks like the year that the system finanly clears out the excess liquity that is posted in the RRP facility, currently it sits at ~120 billion dollars.

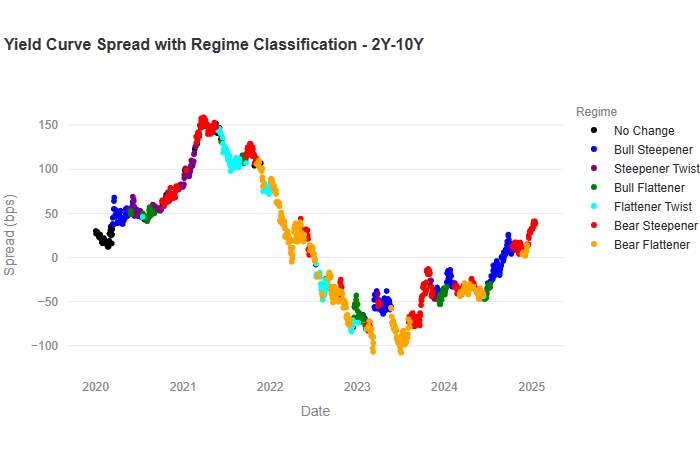

Yield Curve Regime App: Live Demo Available

Why care about the yield curve?

It’s one of the most powerful tools for understanding market sentiment, economic cycles, and rate expectations.

Whether you're trading bonds, analyzing macro trends, or forecasting recessions, the shape of the yield curve holds critical insights.

The curve moves through various regimes, which can be classified as:

Bull Steepener: Long-term yields fall faster than short-term yields.

Bull Flattener: Short-term yields fall faster than long-term yields.

Bear Flattener: Short-term yields rise faster than long-term yields.

Bear Steepener: Long-term yields rise faster than short-term yields

.Steepener Twist: Long-term yields rise while intermediate yields fall.

Flattener Twist: Long-term yields fall while intermediate yields rise.Each regime tells a story about rates, inflation, and growth expectations.

Check out the live app to explore this dynamic, you and your fred api key you can get for free on there website can make you have this power as well!

And if you like it give this post a thumbs up!

Thats all for today folks,

Obrigado,

Cober

Member discussion