Navigating the Impact of Interest Rate Cuts on Housing and the Oil Kicker in less then 5 Minutes

Welcome Back!

In this Week's MacroDispatch, we will examine the Federal Reserve's recent 50 basis point interest rate cut, which has stirred a mix of optimism and caution.

While some see it as necessary to combat housing inflation, others worry about its broader economic implications and the potential backfire effect of reaccelerating the economy too quickly.

Additionally, developments in the oil market, particularly actions by OPEC+, add another layer of complexity.

Let's delve into how these factors might shape the economic landscape.

Interest Rate Policies and Housing Inflation Elevated Interest Rates

Exacerbating Housing Inflation Impact on Construction Costs: Higher interest rates increase borrowing costs for builders. This leads to elevated construction expenses, which can result in a limited housing supply. As supply dwindles, housing prices and rents continue to rise.

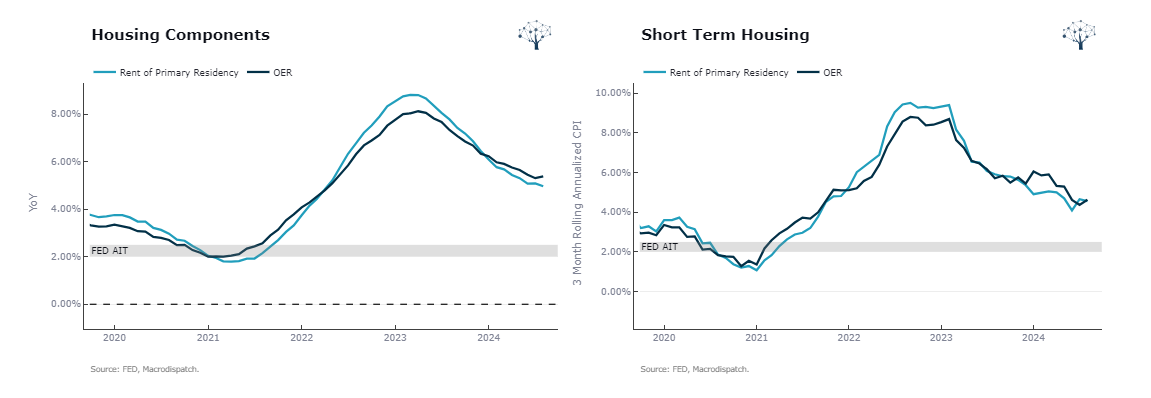

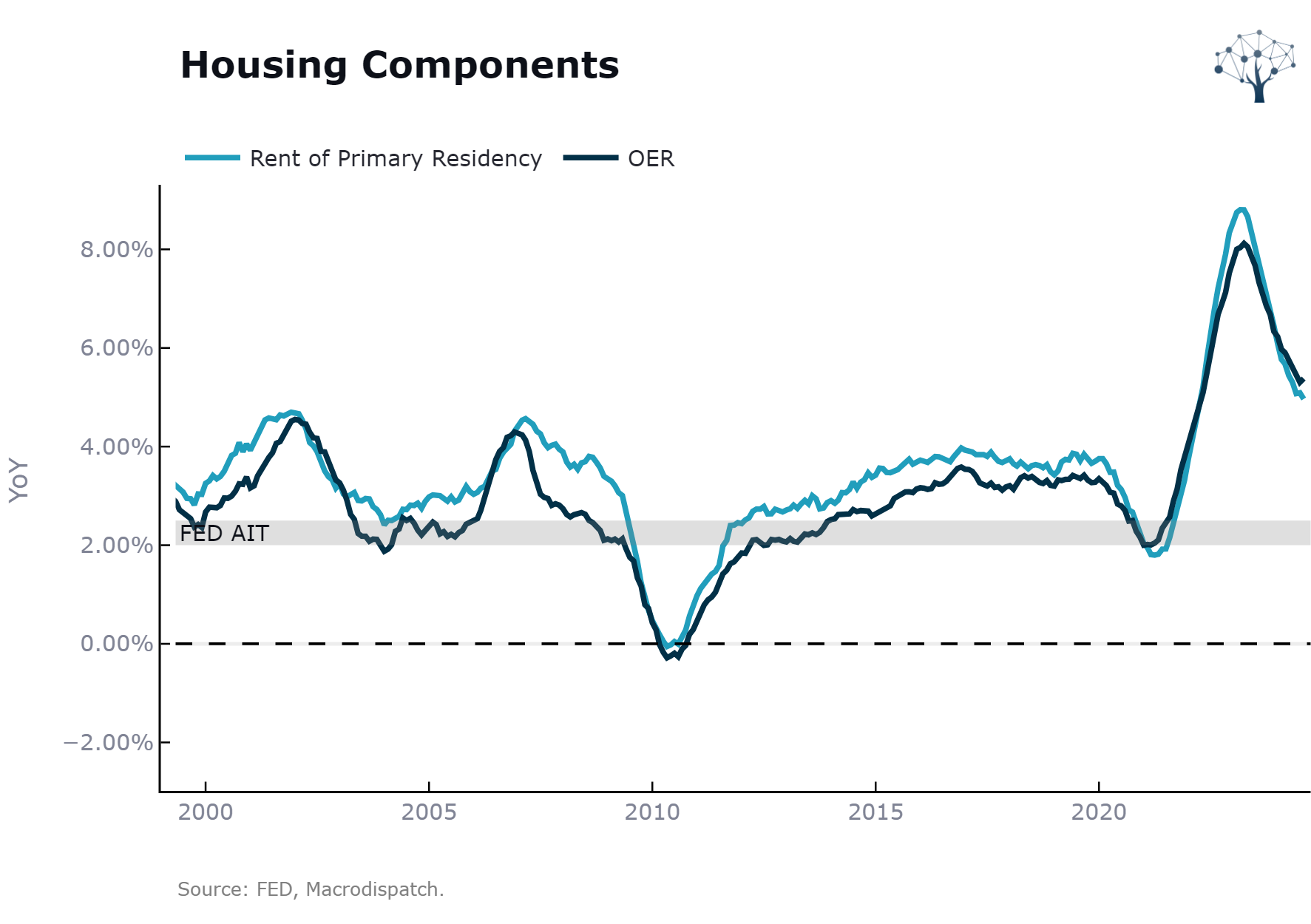

As we can observe OER that is the main housing component in the CPI is currently North of 5%, weel above the Feds Mandate.

Also, Observe it tends to run a little hotter relative to the FEDS Target Range

The 'Lock-In Effect'

Homeowners Holding Back: Many homeowners are hesitant to sell because they have existing mortgages with favorable rates. This reluctance limits housing inventory, contributing to scarcity.

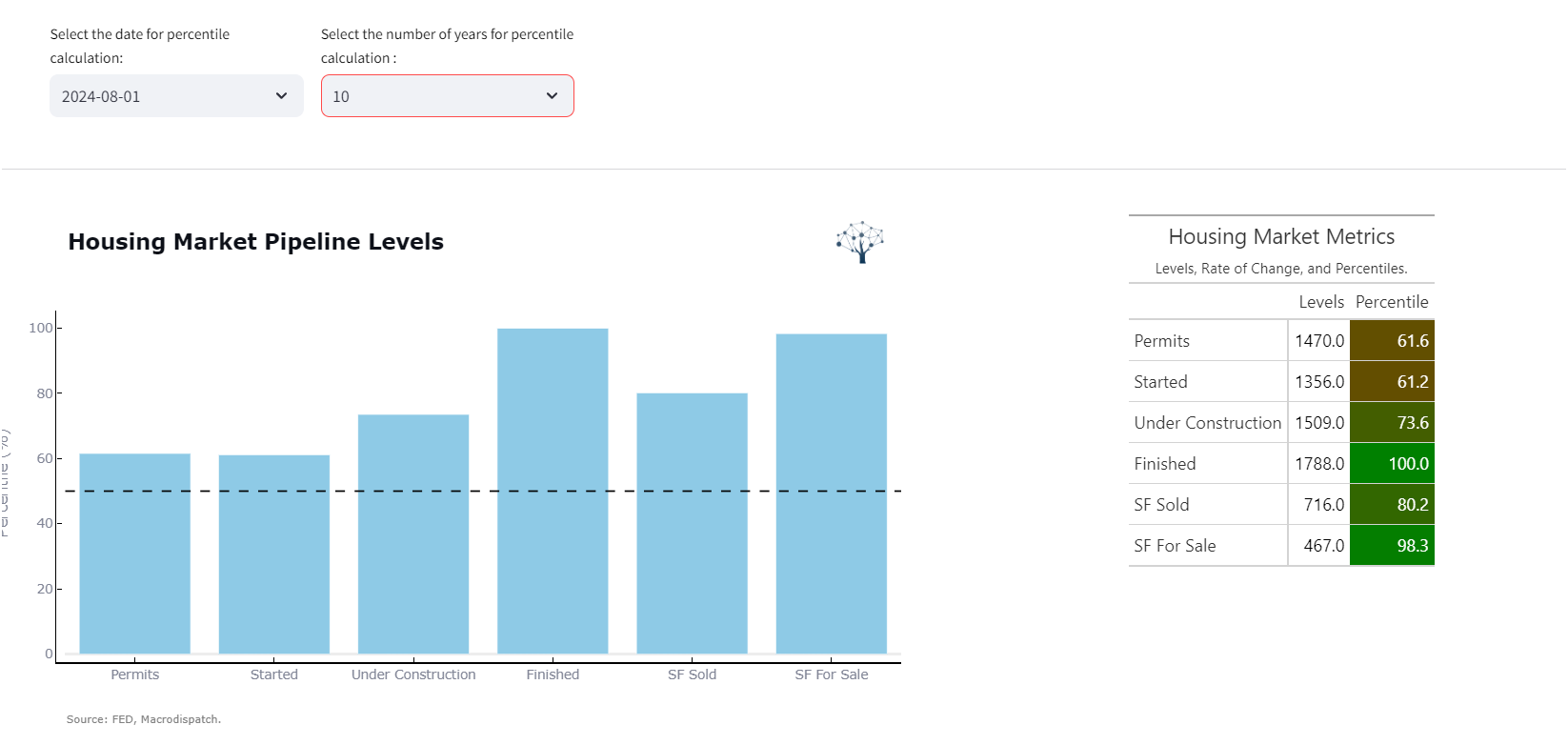

One Thing is Interesting Although the low activity depends on the time horizon look at the percentiles using 10 or 5 years of data.

In the past 5 Years in the context of Booming housing, permits and Starts are low, That said using 1o years of data there above average so no housing bust signals for now

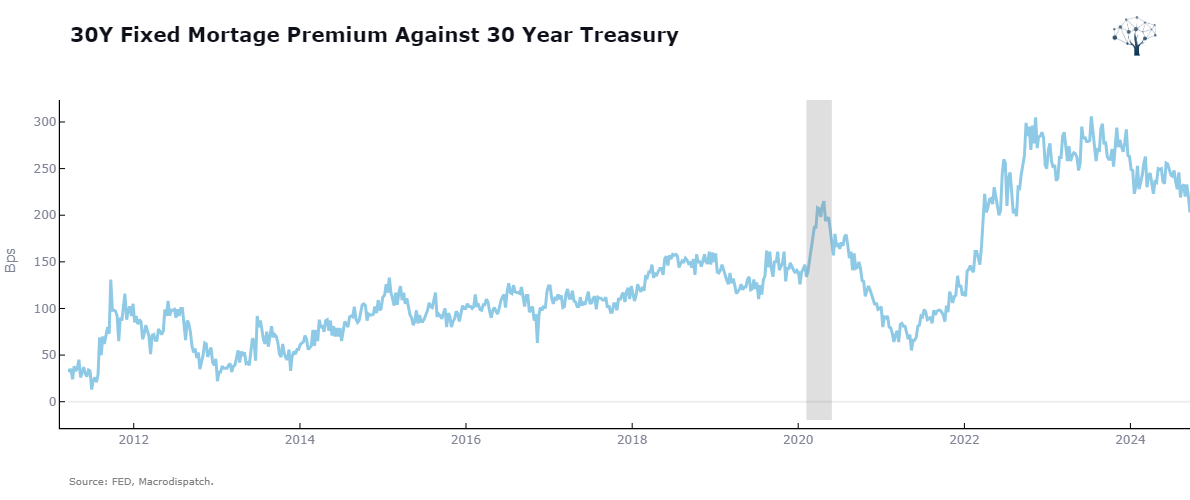

The mortgage rates Premium is storically high and above 6%, A lot of americans got mortages with 3% fixed rates

Finding the Threshold

The Federal Reserve carefully monitors interest rates to find a balance that encourages homeowners to sell, thereby increasing supply and potentially stabilizing prices.

Theres also backfire potential, If mortgage rates drop too quickly, demand could be spurred faster than the supply side can adjust, that dosent look likely for now.

Fed's Dilemma: The Federal Reserve aims to unlock the 'lock-in effect' to boost liquidity in the housing market. However, they must avoid triggering excessive demand that the current supply can't meet.

The Oil Angle Bias

Oil prices, energy, and energy are the base for every economic activity, understanding the trends in oil supply and demand balance is crucial.

Therefore, when you observe that OPEC+ is considering collective output expansion, they are Dropping the 100 Dolar Per Barrel Target and preparing to expand, giving some relief to the production cuts recently observed over the past quarters.

OPEC+ is the closest thing to a central bank of Oil. They try to manage their supply to keep oil prices at Acceptable levels for their pockets; this is their way of providing forward guidance.

The Main Takeaway

The housing market's response to interest rate adjustments and potential oil supply changes by OPEC+ could significantly influence inflation and economic growth. The jury is still out, but getting better liquidity in the housing market looks like what the Fed is aiming for.

While rate cuts aim to make the soft landing complete, they carry the risk of backfiring unless carefully managed.

Remember that in the current context, the Fed has been looking more closely at the employment side of its mandate as Unemployment has been rising.

Also, observing the Oil Market until Year End and the OPEC+ Production Quotas News Will give you an edge on what's going on there.

They have a monthly report with their views and quotas data:

https://www.opec.org/opec_web/en/publications/338.htm

Did you find this in-depth analysis helpful?

If you enjoyed this post, give it like and now that youre Awesome

Here's a Bonus a interactive monitor to keep a close eye on housing market dynamics—the pipeline, prices, and jobs.

Access the Interactive Housing Market Monitor Here:

Member discussion