End-of-Year Repo—Will it Spike

Welcome back to Macrodispatch, and early Merry Christmas to all!

TLDR—Repo rates will likely spike again as year-end market imbalances persist. The take-up of the SRF (Standing Repo Facility) will be the key variable to watch: its timing, size, and allocation to the right counterparties will determine its effectiveness.

Last week, the Fed announced upcoming adjustments to the Standing Repo Facility parameters, with the intention of lowering year-end repo market volatility.

Last year’s spike, where SOFR 99% hit nearly 570 bps, highlighted the impact of low liquidity and imbalances in the GCF repo market. This spike was driven by dealers with excess balance sheet capacity lending at higher rates as smaller dealers scrambled to secure funding. The GCF volume bid reached $170 billion in the final week of 2023, reflecting the intense competition for balance sheet space.

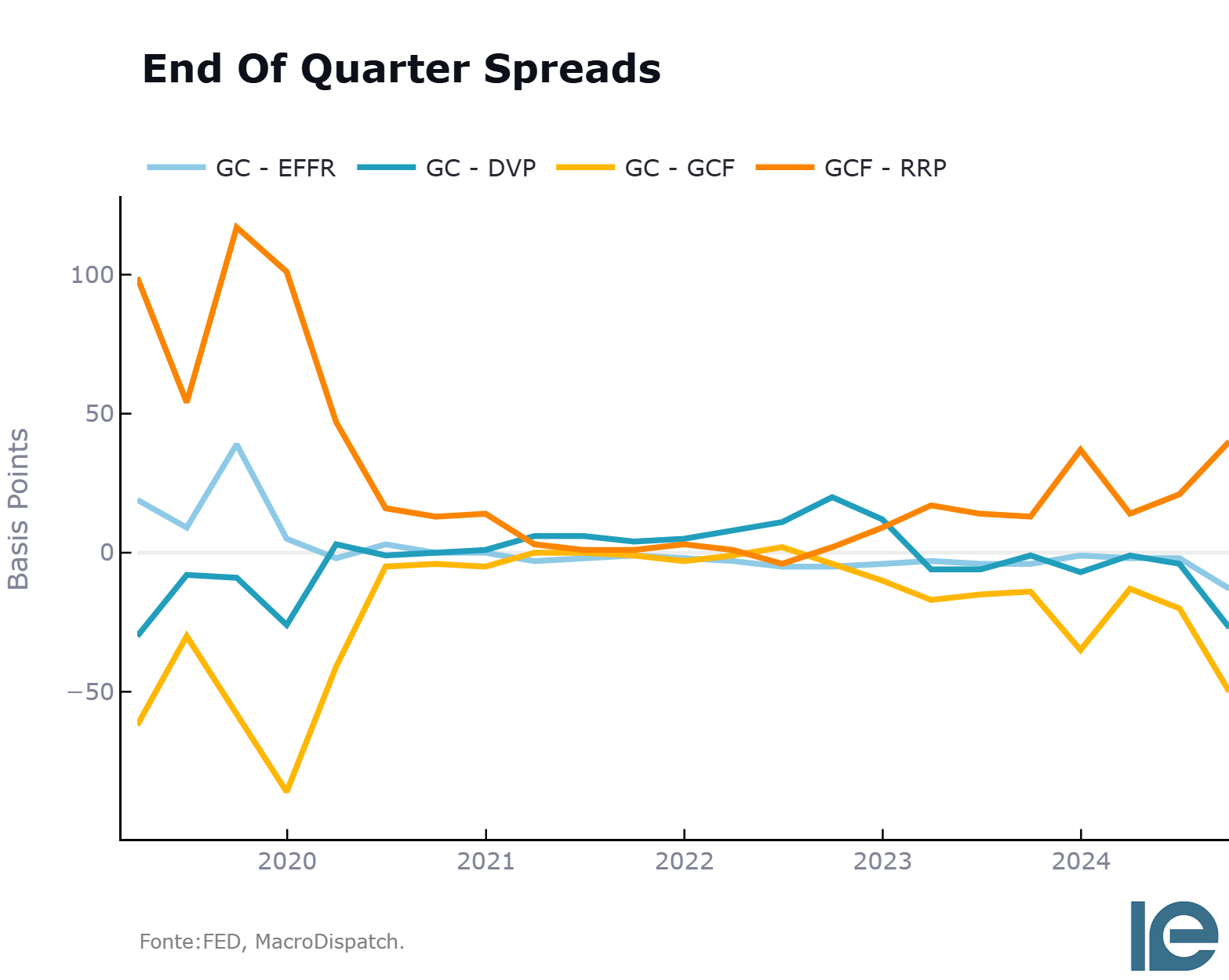

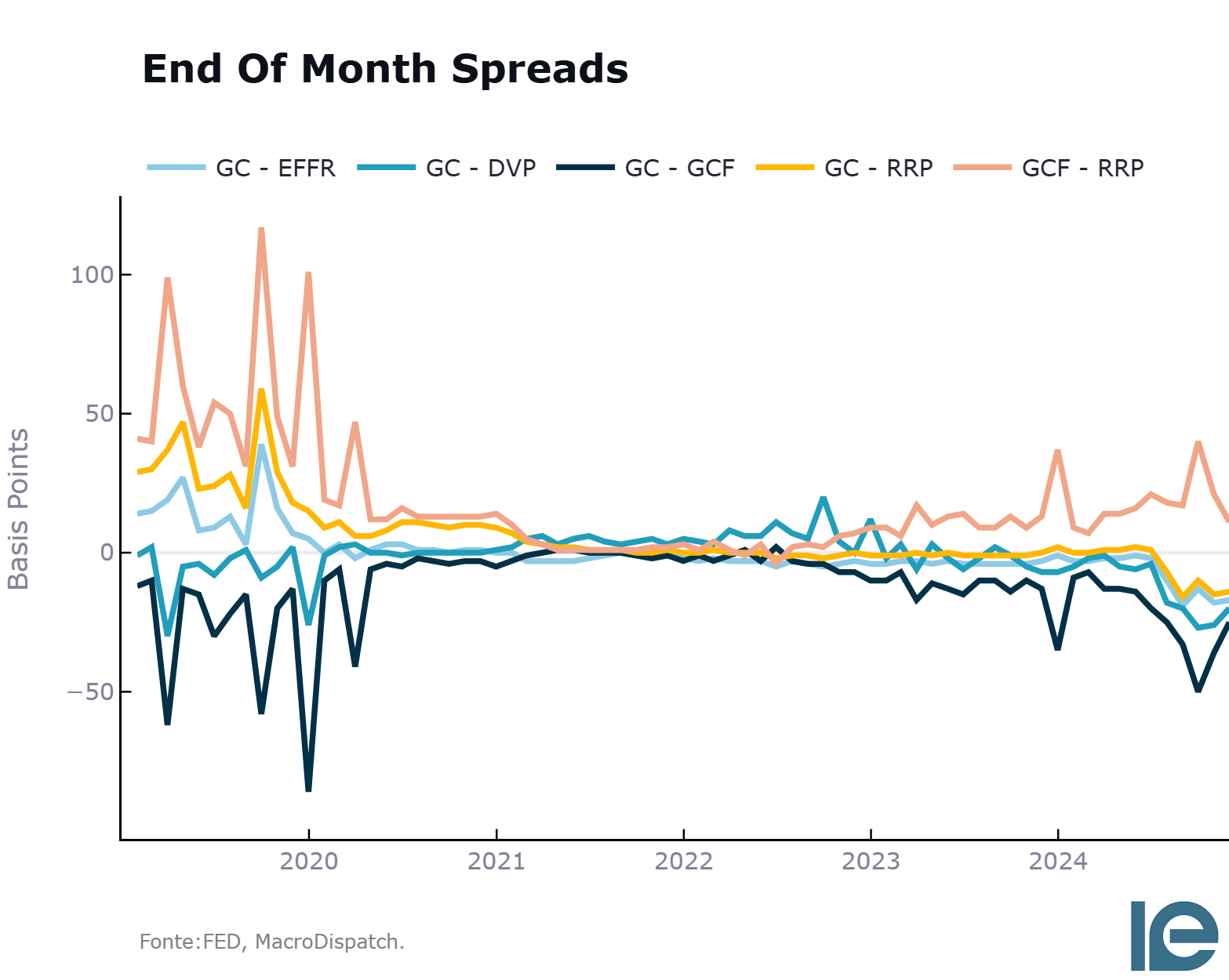

Repo market volatility typically increases at the end of months and quarters, and year-end is no exception.

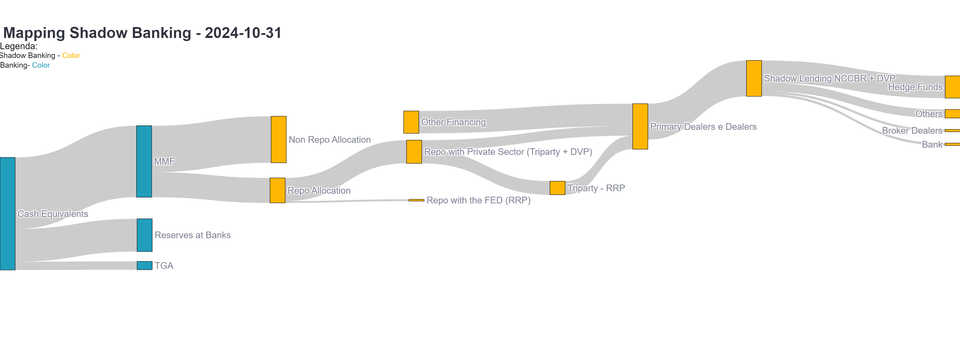

Comparing spreads against GC tri-party repo further illustrates the impact of strained liquidity.

It's also clear we are not at September 2019 levels.

Factors to Watch

Positive Factors:

- The Fed reduced the Reverse Repo Program (RRP) rate by five basis points, potentially easing some year-end funding stress. With $130 billion parked in ON RRP, this could provide marginal relief. Although it's not that big of a cushion.

- The SRF’s earlier opening time at 9 A.M. will enable funding earlier in the day, with 70% of DVP repo and 50–60% of GCF activity completed by then—far better than the previous 1 P.M. opening.

This will happen at 9 A.M. Following OFR data, this will happen after 70% of the DVP repo has happened in the regular day and 50-60% of GCF, better than at 1 PM when that percentage is closer to 90%.

Negative Factors:

Demand for funding is soaring, driven by hedge funds seeking to profit from basis trades and increased leveraged stock market exposure. This pushes dealer balance sheets to their limits.

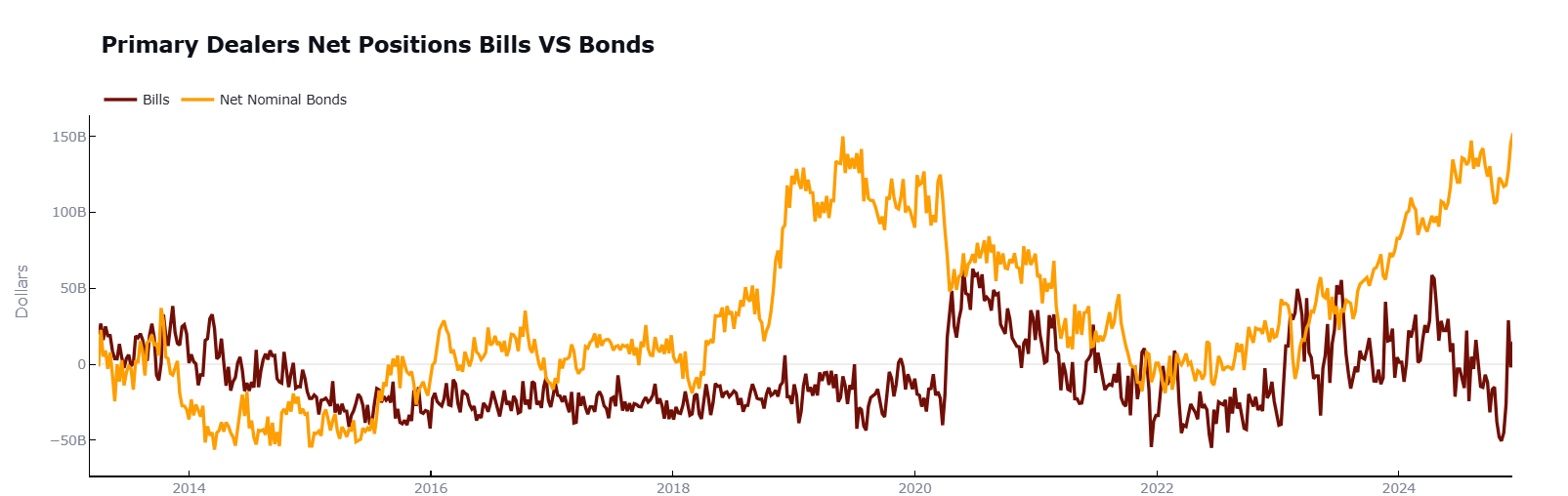

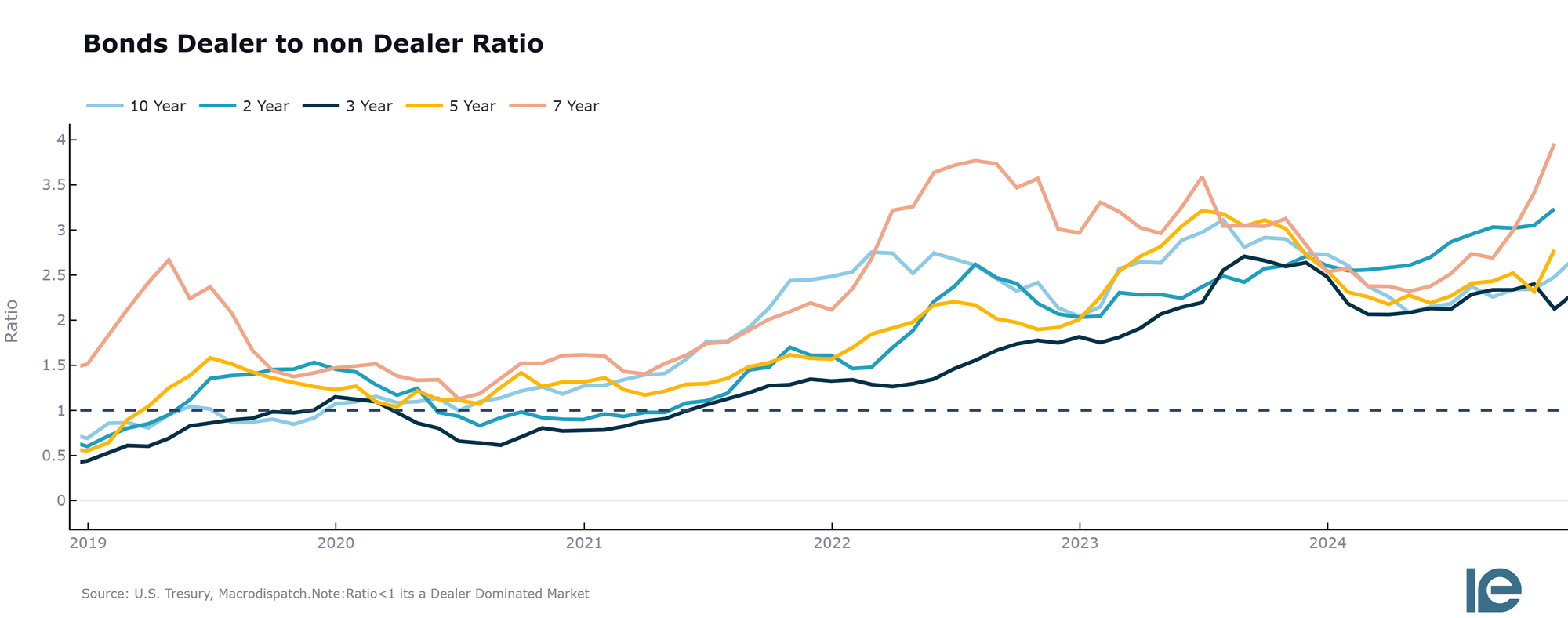

At the same time, there's a lack of demand for U.S. sovereign debt, forcing them to absorb record levels of unwanted inventory. Consequently, we observe dealers' highest net bond positioning in the (first chart below)- which coincides with buying up four times more bonds than auctions and non-dealers (second chart below).

The SRF inherited the Discount Window stigma; although useful in theory, primary dealers have not adopted it on a large scale since it could be interpreted as a balance sheet weakness. The stigma is still larger then to make the marginal basis points of profits

Big banks are also entering the window dressing period, and repo activity and derivatives are decreasing so they don't incur higher G-SIBS surcharges.

In plain English, they're cutting weight to show the regulators they're still inside their weight class rules (next quarter).

As a consequence of the weight cutting, they don't want to deploy as much capacity to the repo desks.

The withdrawal of their repo funding can lower the liquidity of smaller dealers/broker-dealers that could use primary dealer liquidity to pass on repo funding to their clients.

Since their funding counterparty is absent, they bid up the available liquidity in repo, mainly the GCF, where counterparties are anonymous, competing for extra available balance sheet space.

It's interesting to add that major U.S. financial companies, such as JPMorgan, Goldman Sachs, Morgan Stanley, and Bank of America, have one thing in common in this context.

They are all American G-SIBS with primary dealer subsidiaries, a significant footprint in the U.S. Money Market Funds, and are eligible counterparties to the SRF.

My working hypothesis is that it's not clear there are the right incentives for these primary dealers to change their actions to prevent a bid for repo liquidity caused by a lower primary dealer supply as a root cause of their parent companies (banks) pulling out for regulatory reasons.

Therefore, there is an adjustment since the repo participants don't know what funding will be pulled, just like a game of musical chairs.

The answer is that while we don't have the right incentives or lower stigma for the SRF, it is a bid for certain repo funding in the result of this puzzle, for now.

With that in mind, for live updates, access to our free interactive monitor is available in the link below; explore the data!

Get your brain fried a little...

For today, that's all, folks!

If you like the content, subscribe and share it with your network!

2025 will be a great year; let's see if the repo starts above or below the top of the Fed Funds range!

I hope you enjoyed my end-of-year repo rambles.

Cober

Member discussion