Data Updates - New Tool and Take a Look at Crystal Ball Trading Game

Welcome Back to MacroDispatch,

This week, I have been working on a project to make better content for you guys!

Ive now started in the world of Generating Animated Charts:

Here's a little preview of what is to come!

Helping give movement for macro narratives one data point at a time!

Lets Talk about Trading Concepts and how to make you and me suck less!

Have you ever thought about using Fixed Bet Sizes in your trading?

It might sound a little boring at first, but this approach could be your key to maximizing your risk-reward ratio while keeping stress levels low.

Let's dive into why Fixed Bet Sizes aren’t just for beginners, but a smart tool for every trader.

Consistency is Key

One of the hidden advantages of Fixed Bet Sizes is consistency. By sticking to a fixed amount per trade, you're smoothing out the highs and lows that come with the volatility of the market.

Instead of riding the emotional rollercoaster that comes with variable position sizing, where a 3% win follows a 5% loss, Fixed Bet Sizes keep you grounded and focused on the long-term game. This consistency can help make your trading journey more predictable and less stressful.

Remember positive, trading is about positive Expected Value Bets, so act acordanly!

It's all risk management!

This strategy also helps to combat the "gambler's fallacy"—the mistaken belief that past outcomes influence future probabilities. Fixed Bet Sizes keep you rational, ensuring that you don’t make emotional decisions based on previous trades.

In conclusion, take into account the power of Fixed Bet Sizes. L

ike great chefs say, "Less is more." Consistency is what wins the race in the long run, and Fixed Bet Sizes can be your steady partner in the volatile world of trading

Applying This Strategy

To apply Fixed Bet Sizes using the beta tool for position sizing, you can incorporate market volatility into your trades.

For example, I want to risk a 1.5-sigma move up over your selected timeframe, and my stop loss is 1 sigma.

This helps create a positive skew and a framework to think about your trades and their sizing.

Now you size the risk move, size your tolerance, what's your average % of the portfolio you want to risk!

And bam, you have the number of contracts, and that will risk X amount of capital with the risk profile you're interested in!

Again, do your own research; this is only for Educational purposes!

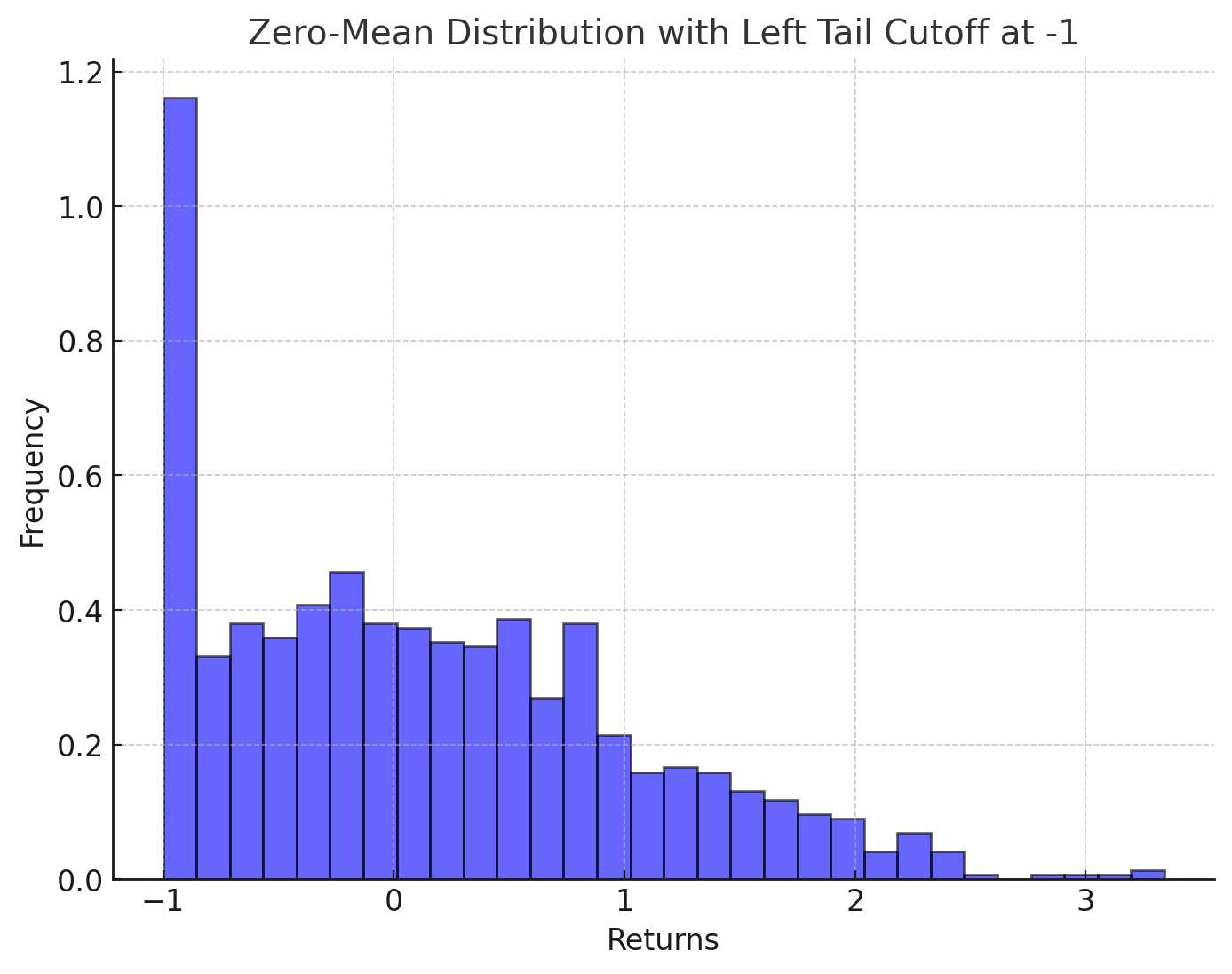

This is the type of trade structure youre looking for consistent stops and a positive skew, the high -1 is risk management working so that tha your pnl is not impacted by the -2,-3 you could suffer.

Have This in mind?

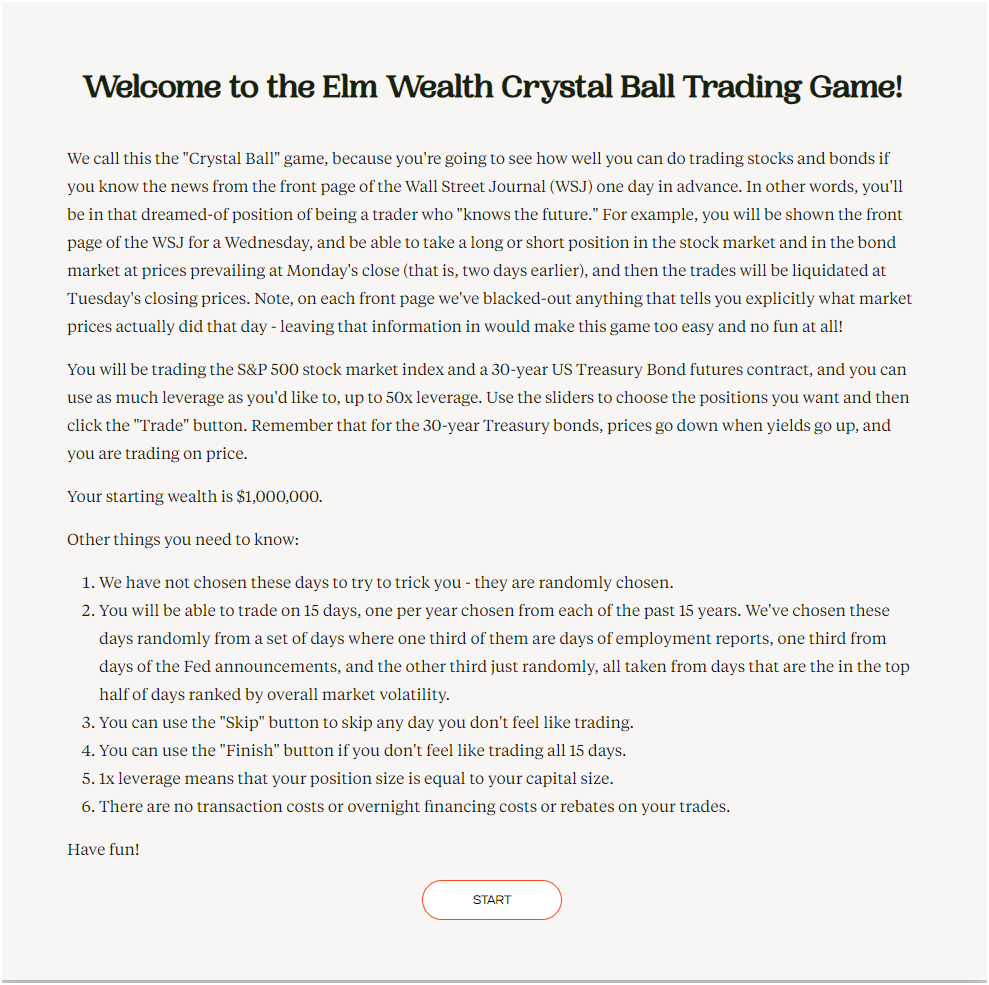

Here is another game for you to apply these skills!

If you haven't Played this, access this link immediately!

And as we talked about today, position size accordingly!

That's All for this week,

If you liked this content, share it with a friend; that's all I ask!

Obrigado,

Cober

Member discussion