Data Update - Vol Adjusted Asset Moves Report

Welcome back to this edition of Macro Dispatch. This week, we're revisiting volatility—an inherently unstable yet widely utilized metric in asset management.

As you know, volatility is not constant across different timeframes or periods. Yet, some form of it underpins key concepts such as position sizing, trading strategies, and risk management.

This week, we’re excited to introduce a unique tool. The concept is straightforward:

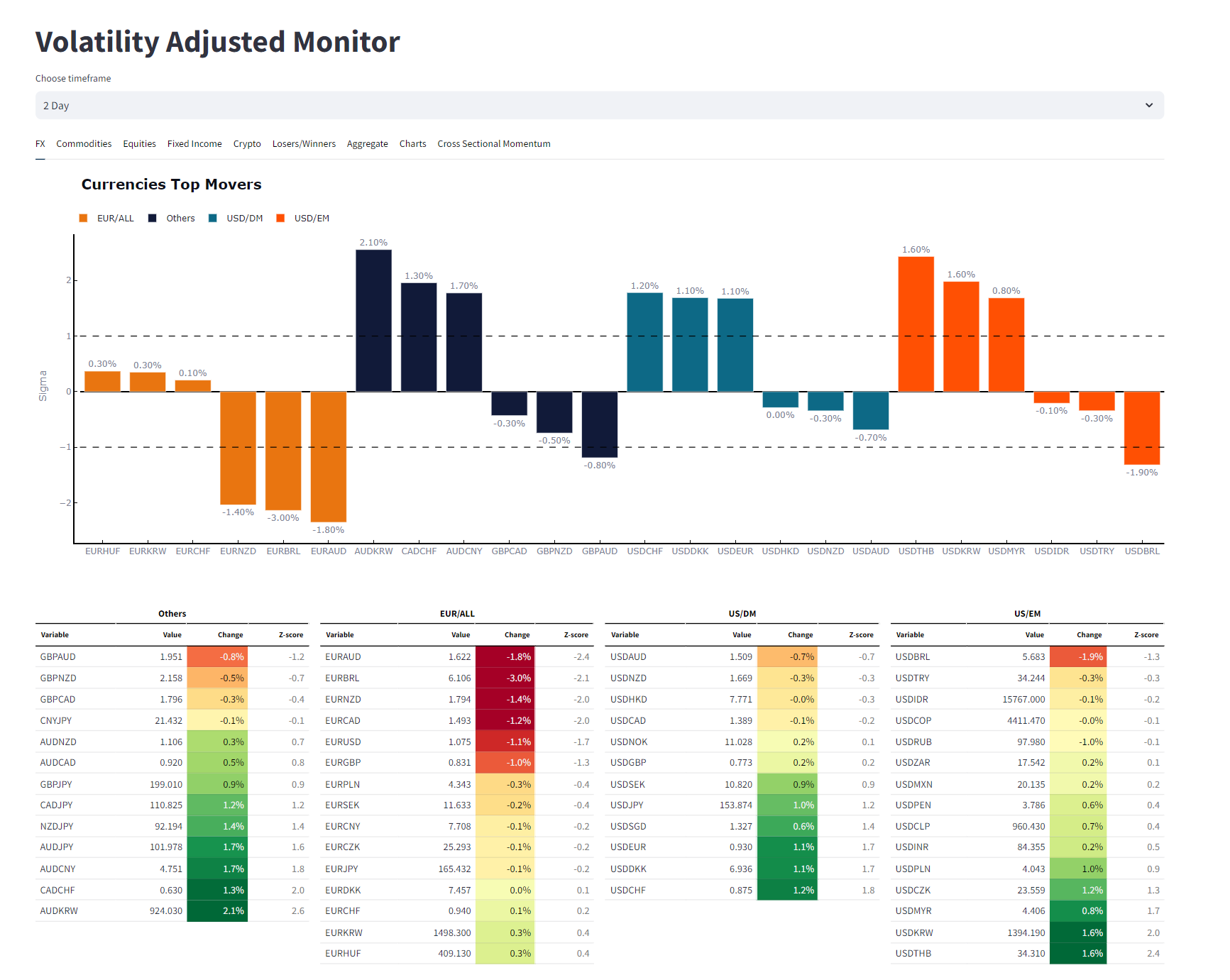

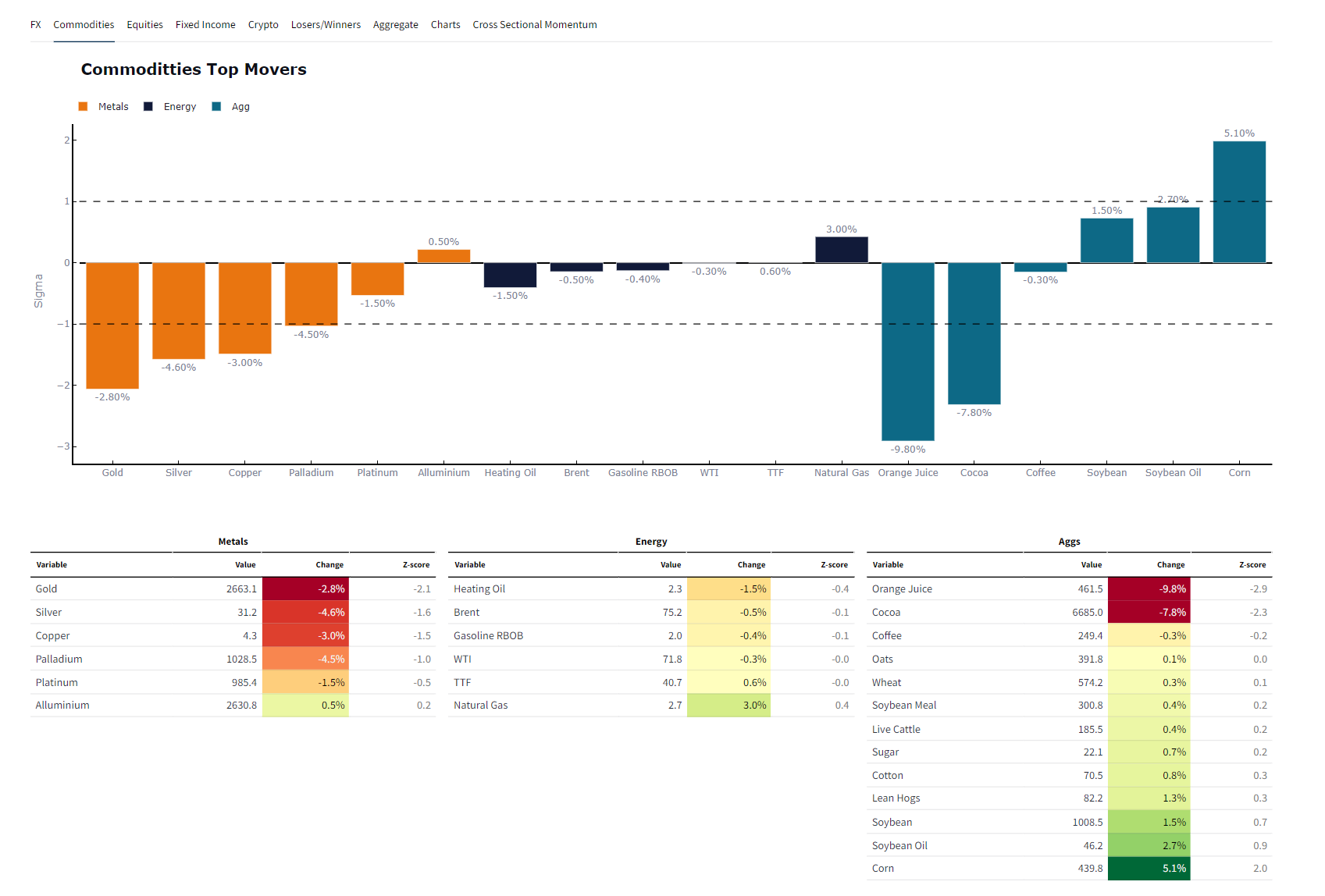

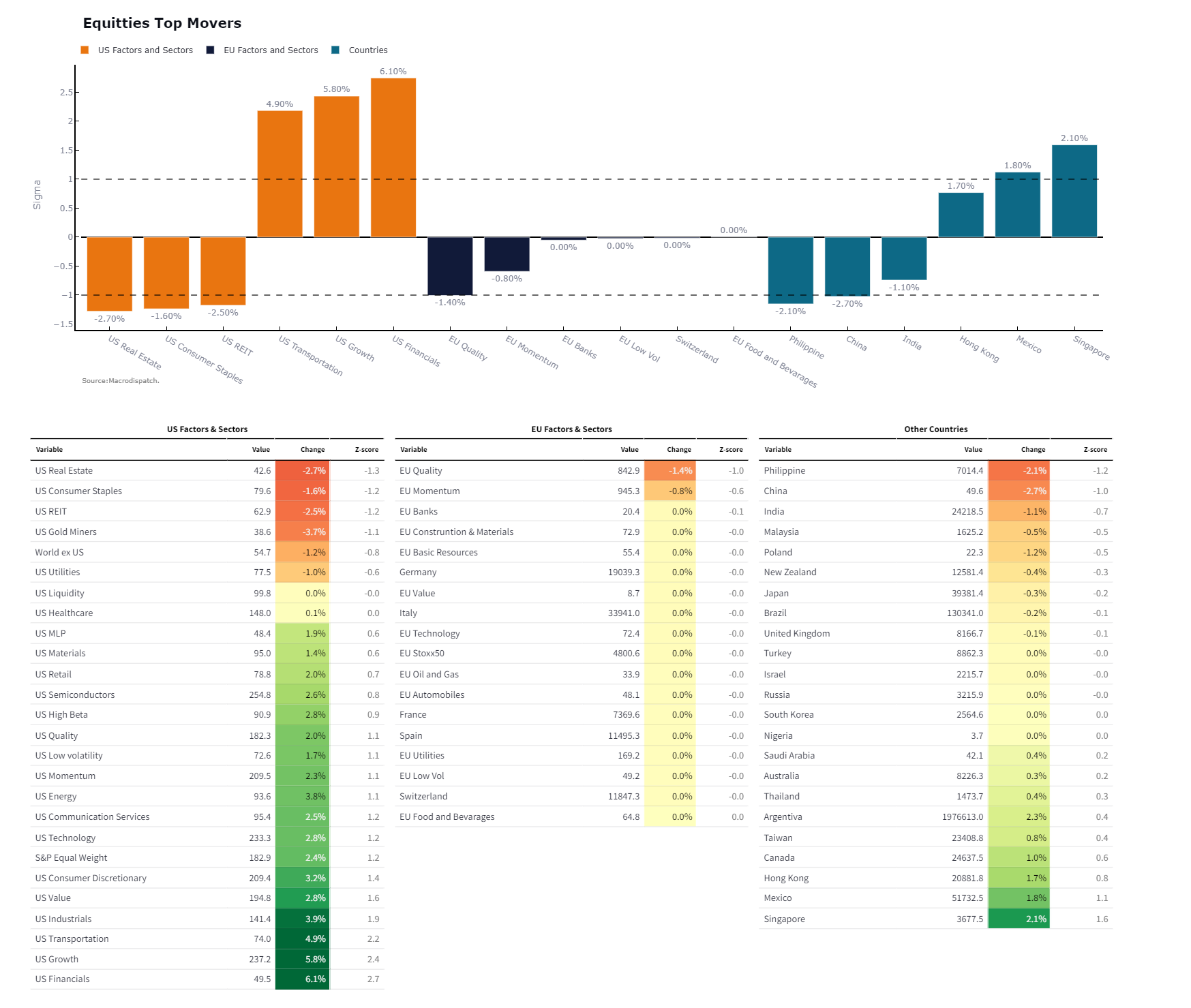

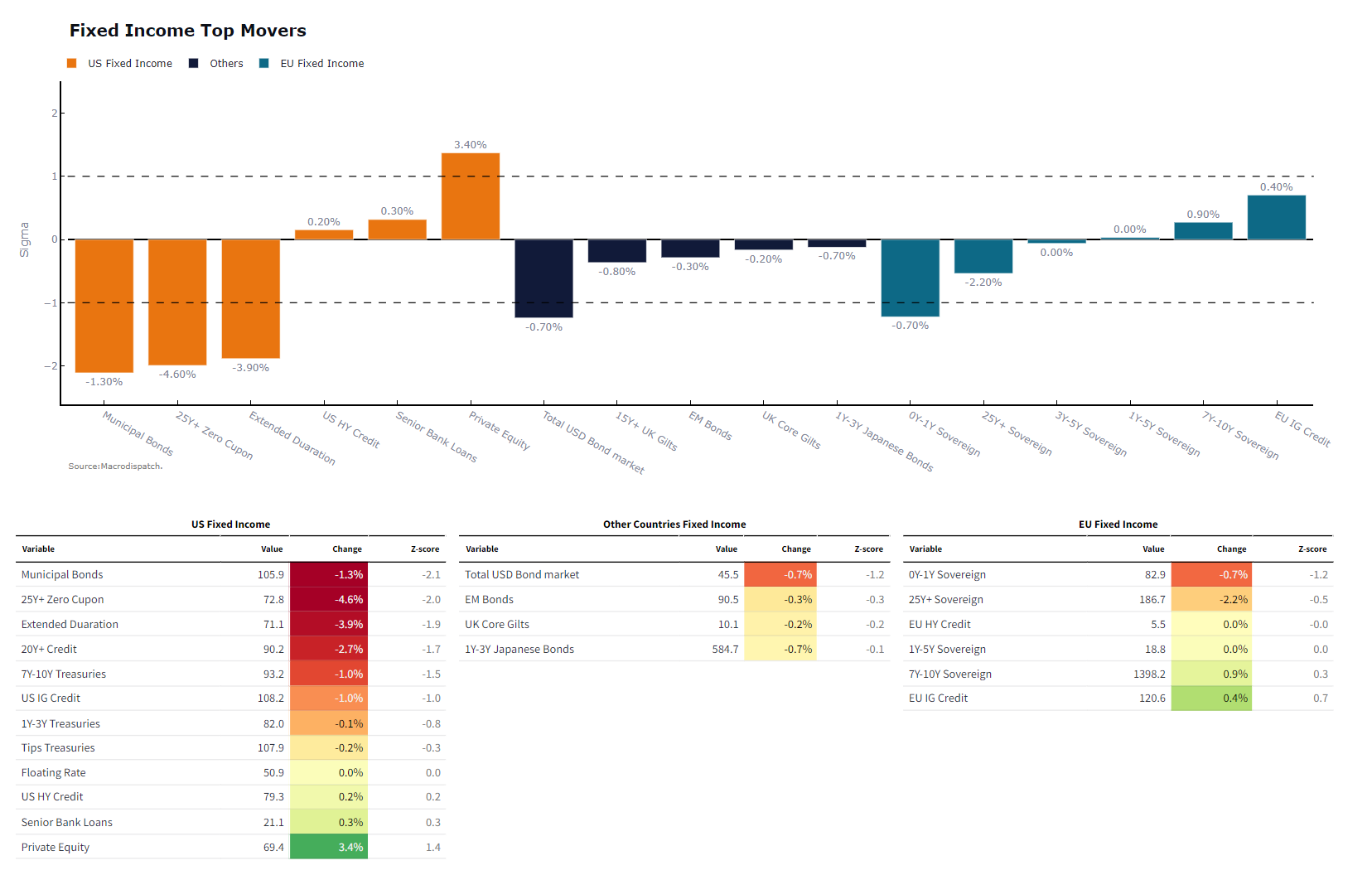

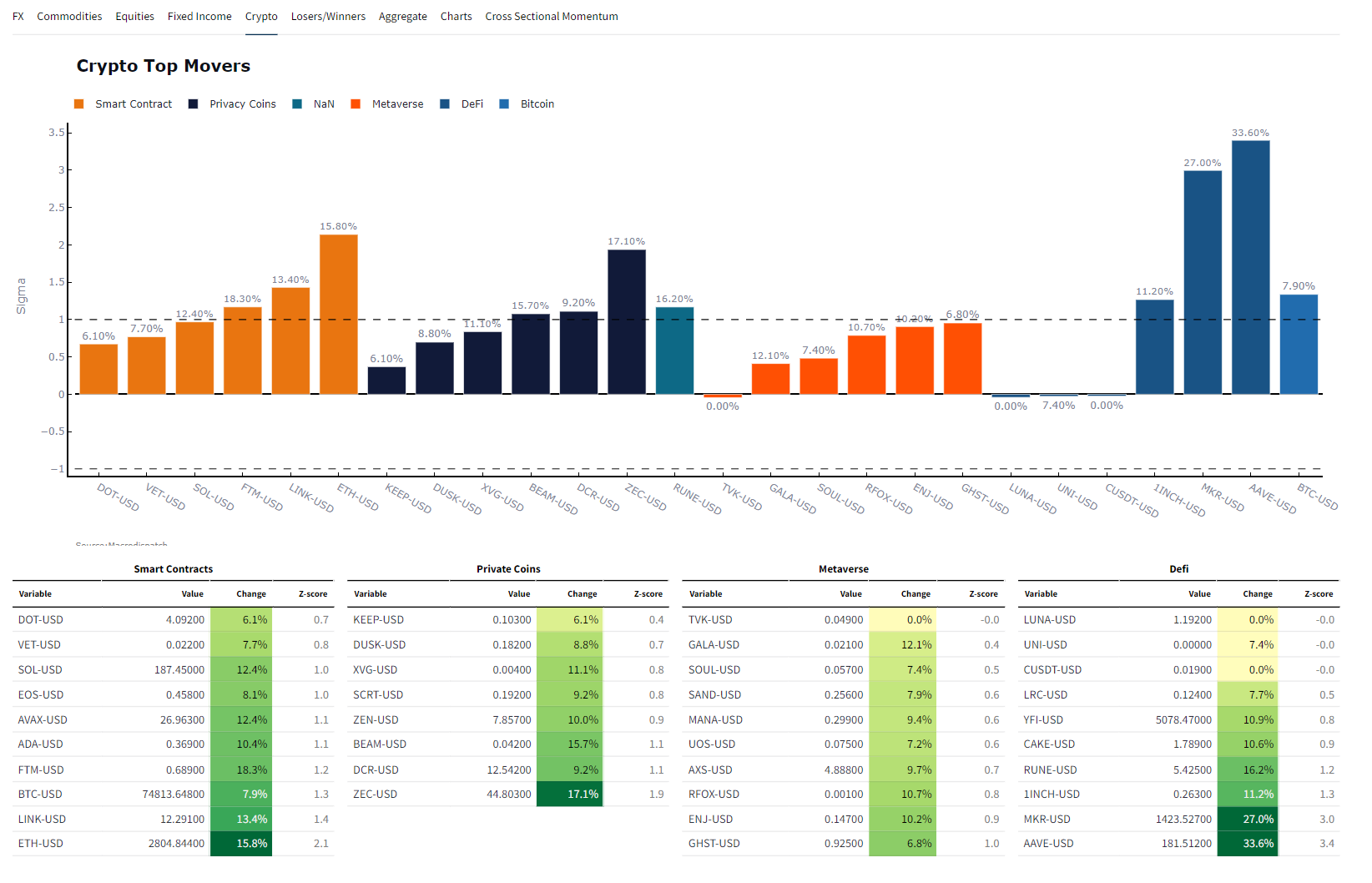

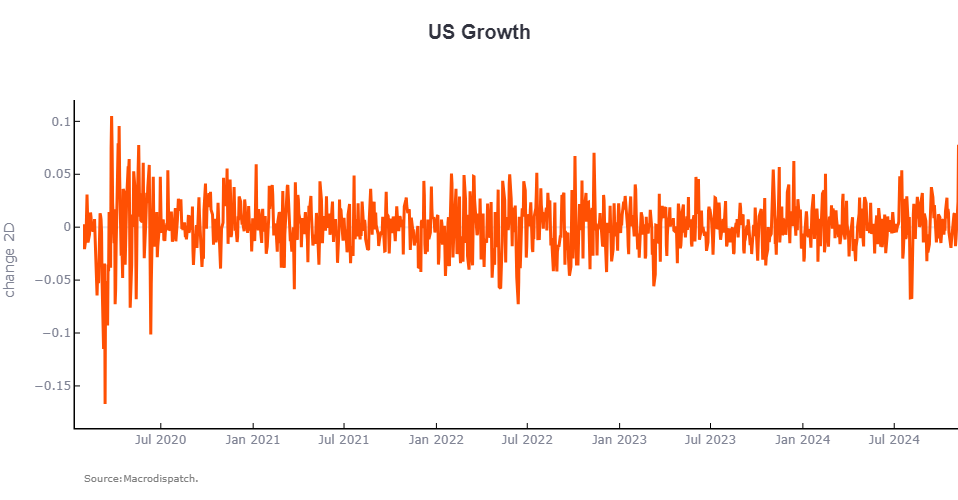

We'll examine cross-asset movements in ETFs, commodity futures, and cryptocurrencies over various timeframes, aiming to visualize the most significant deviations based on the average volatility of the past five years.

To achieve a consistent comparison across assets, we utilize Z-scores, which enable us to standardize movements for an apples-to-apples comparison rather than apples-to-oranges. Ultimately, this helps us identify where supply and demand for an asset have triggered unusual activity.

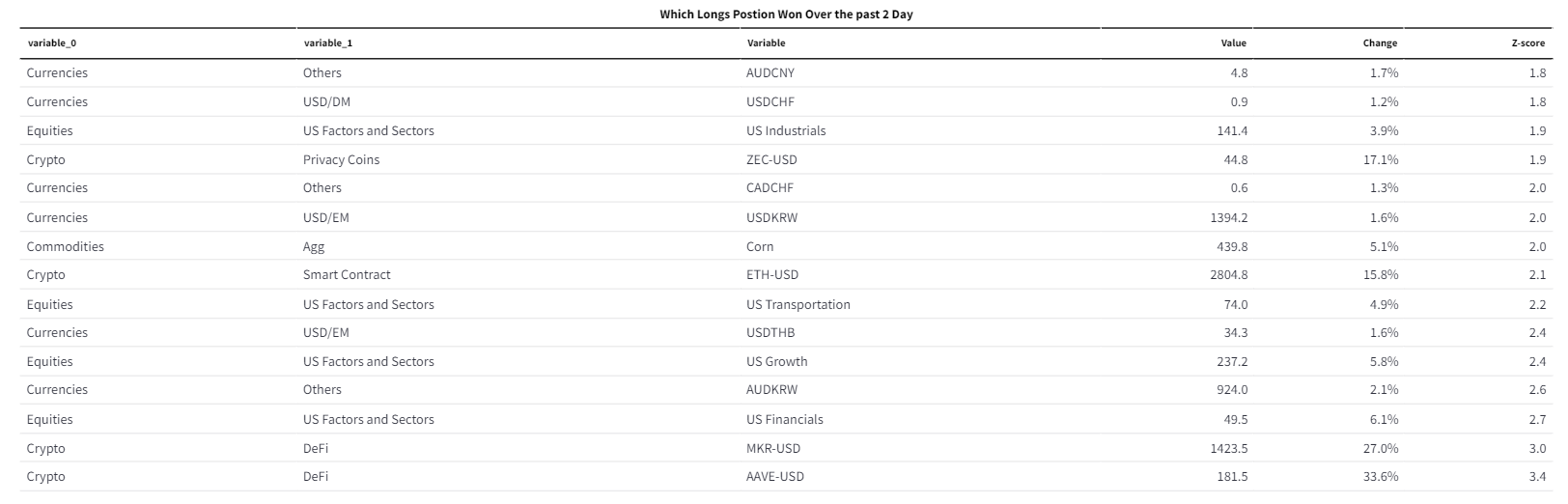

The recent U.S. election results will serve as a case study for the most significant moves in the past 48 hours. In this instance, we focus on the last two days, though the timeframe could easily extend to one week, one month, or even three months.

All asset moves, but this lets us clearly see what has moved the most!

From all of this data, we can Filter a list of the worst-performing and best performing vol-adjusted cross-asset moves for these specific elections without getting too deep into the weeds of single-name equities.

The biggest losers are the Euro and US fixed-income securities with long duration, which reflect the pricing in of higher inflation expectations and fewer Fed cuts.

Also, with the Dollar's strength, Lower Euros and Gold have been priced.

Orange Juice and Cocoa are not election-related, although Trump making orange juice prices drop would be a interesting headline...

The Biggest Winners were certain US Sectors, Crypto, and the Dollar.

In the end, the reports help you bring attention so that you can see what's moving and have moves like this below.

Thats All for today Folks,

As always, the tool is live and updates hourly,

Go check it out. Since there are lots of newcomers,

it's an application made for the web, and if you're a dark mode user, you might need to change the settings.

To access it, click the link below!

If you like the tool, please share it with a friend or on social media—that's all I ask!

Obrigado e until the next data drop!

Cober

Member discussion