No take-up and a spike

Are Repo Markets Sending a Warning Signal About QT?

Welcome back to the first edition of macrodispatch in 2025. I hope you all had a nice end-of-year and went to touch some grass away from the brain freeze that is following repo markets.

Following up from our last article, It did Spike!

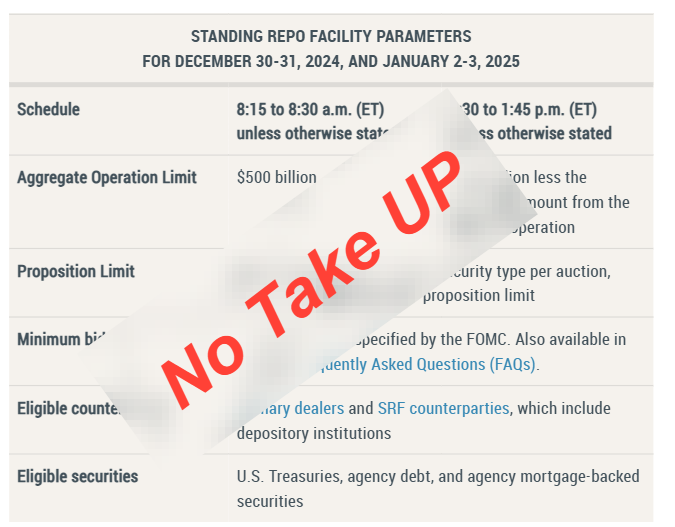

And there is no take-up on the SRF, so the stigma + access to the money market agents that don't need/want that liquidity even earlier in the day is confirmed.

Work has to be done.

,

Repo spreads spiked sharply at year-end, driven by G-SIB banks pulling back from repo activity for regulatory reasons. This left the market scrambling for the remaining liquidity, creating a clear stress point.

The most notable effects can be observed in the GCF (General Collateral Financing) repo rates, which experienced significant upward pressure of 40-50 bps at year-end, higher than the 20-30 last quarter end.

But there’s more: the average SOFR-EFFR index is now climbing back to pre-pandemic levels. Repo markets, once dormant, are showing signs of life again.

As quantitative tightening (QT) progresses, the Federal Reserve has signaled it’s not aiming to repeat the September 2019 "repo-pocalypse."

But the big question for 2025 remains:

When will QT end?

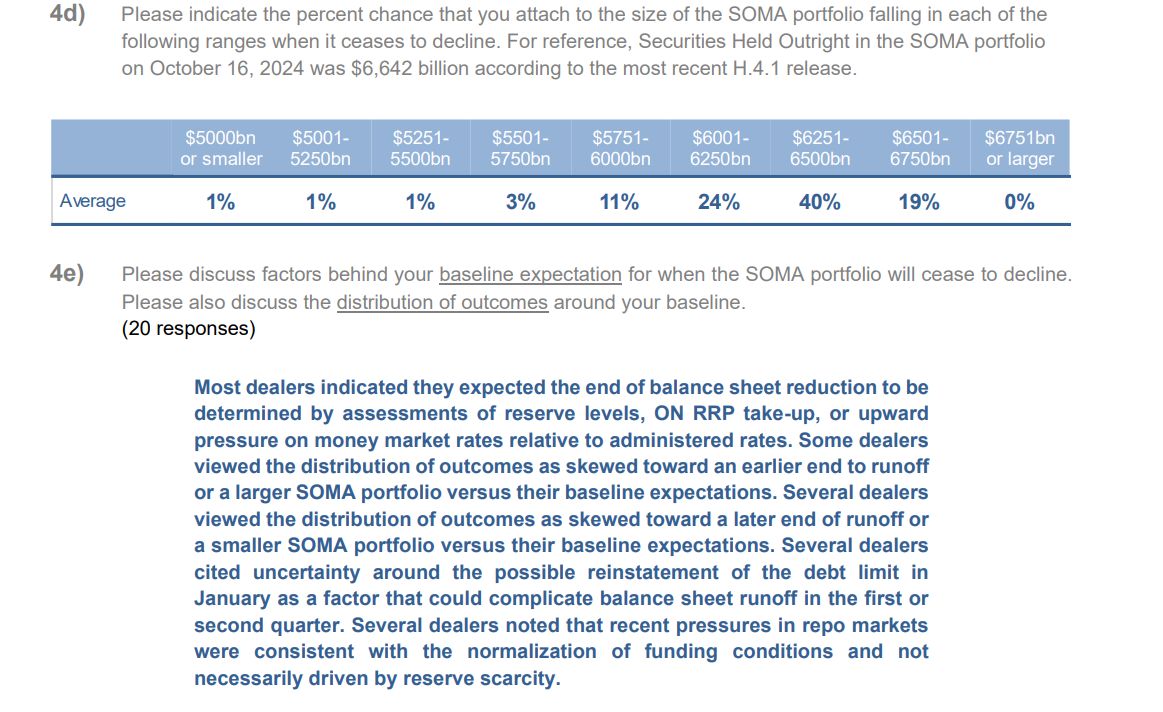

Primary dealer surveys provide some insights.

The median projection suggests QT could wrap up by May 2025, with reserves settling around $3.125 trillion.

Yet, there’s a catch. Several dealers see risks skewed toward a later end to runoff or a smaller SOMA portfolio than baseline expectations.

Uncertainty looms large, with factors such as a potential reinstatement of the debt limit in January complicating the balance sheet normalization process. However, recent pressures in repo markets appear more reflective of normalized funding conditions rather than outright reserve scarcity.

Also, the most likely ending is a SOMA portfolio with 6 to 6.5 trillion dollars.

The takeaway: While year-end liquidity pressures are largely a normal regulatory process, primary dealers are beginning to see light at the end of the QT tunnel, with expectations of balance sheet stabilization as early as Q2 2025.

While the Fed aims to maintain stability, the intersection of liquidity management, regulatory constraints, and fiscal uncertainty will make 2025 a defining year for the QT narrative.

If you enjoyed the article, share it with a friend,

And if you want to support the project and use the repo monitor in a professional setting, consider subscribing or donating to the project.

Hope you all enjoyed it, and a happy new year,

Cober

Member discussion