ATI VS Debt Management

Welcome back,

The Treasury’s approach to debt issuance has been sparking debate —is it truly a critical issue for market participants, or just another talking point? Get Ready for a battle of Former Treasury Employees!

On the Red Corner, Neil Rubini and Steven Miran, propose that the Treasury is doing Activist Treasury Issuance (ATI).

In the Blue Corner we have Amar Reganti, laying out the argument defending the treasury perspective on Debt Management and the fact there is no such thing as ATI.

The structure of the Article will be show the principal components i found most interesting and debate the market impact:

- ATI Thesis

- The Amar Reganti rebutle

- Does Who is Right Even Matter

- Buybacks, The canary in coalmine of a new Liqudity Paradigm

Neil Rubini and Steven Miran

Activist Treasury Issuance

The Concept of Activist Treasury Issuance

Traditionally, the U.S. Treasury balances its debt issuance between short-term bills and longer-term bonds, a strategy designed to maintain market stability and efficiently manage the government's financing needs.

However, the paper by Miran and Roubini argues that the Treasury has deviated from this norm by issuing more short-term bills and fewer long-term bonds than usual.

This shift, termed "Activist Treasury Issuance" (ATI), is akin to a form of quantitative easing (QE), but with a twist—it operates through the issuance process rather than the Federal Reserve's direct bond-buying activities.

How Does ATI Work?

The mechanics of ATI are straight forward. By increasing the issuance of short-term bills, the Treasury reduces the supply of long-term bonds available in the market.

This scarcity drives up the prices of these long-term bonds, subsequently lowering their yields, relative to a all else equal world (Most Used Economist Word in gradschool, master or PHDs).

This is important Because they the Econ Mantra to point out these Studies,

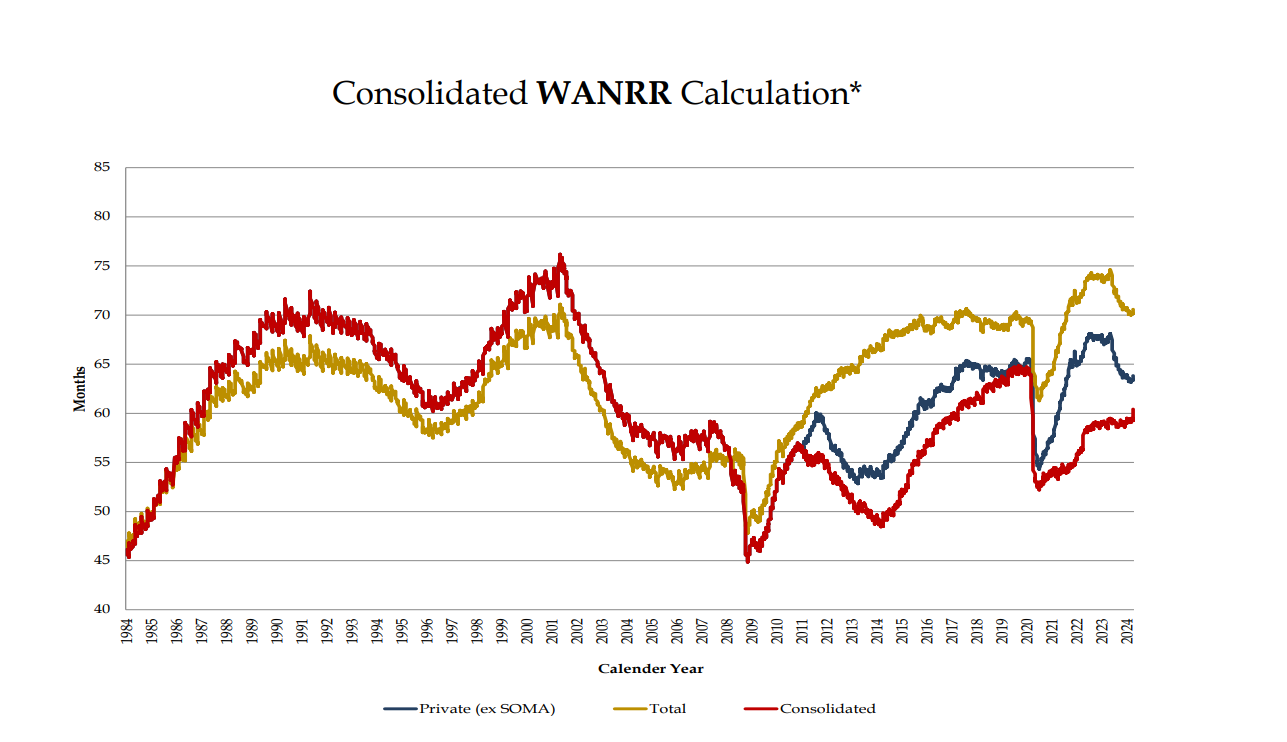

- Greenwood and Vayanos (2014) The WAM (weighted Average Maturity) of Treasury securities affects term premiums, with different studies providing estimates from 14 to 40 basis points depending on the method and period analyzed.

- Hou (2018) highlights that a one-year WAM extension in a positive stock-bond correlation environment has a more substantial impact on term premiums (wich is the case today)

Translating from jargon to twitter Jargon:

The Treasury Actions Altered the way this should work, and theres no free lunch!

Miran and Roubini, In essence, argue ATI achieves similar outcomes as the Fed's QE programs, but through a different channel—one that some argue could be politically motivated and undermines the Fed's indepedent monetary Policy.

How to See ATI From There Lends is two fold:

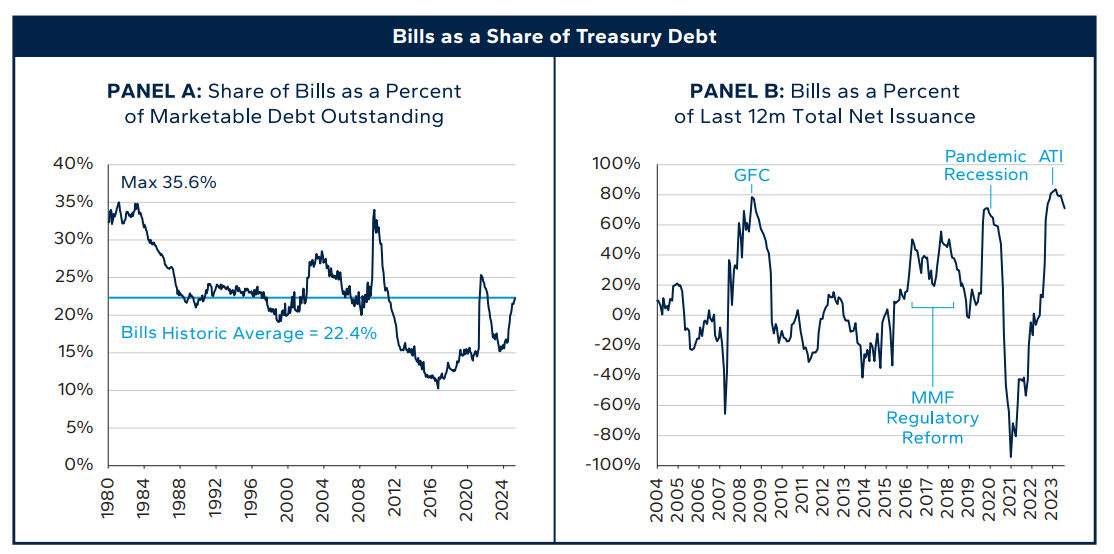

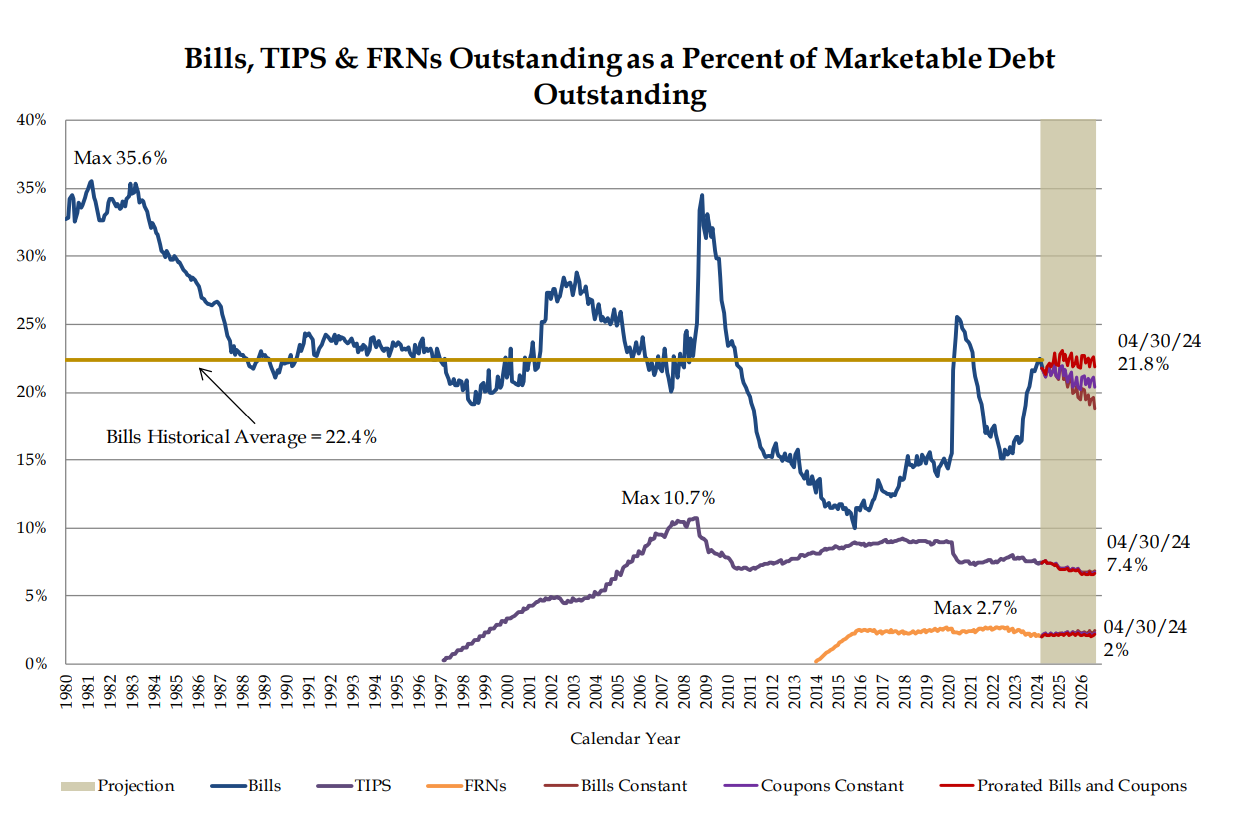

The average interest Rate Risk in the Private Sector is Lower than the Pre-pandemic average, and the Bills as a percent of the last 12 Months of Total Net Issuance are basically at an all-time high!

Whats the Price?

Treasury will need to normalize the debt. The authors point to a terming out of 1 trillion dollars of bills starting as soon as 2025.

If ATI is unwound via terming out $1 trillion of excess Treasury Bills, we expect it to temporarily boost 10-year yields by 50 basis points before settling into a permanent 30-bp increase, with corresponding price changes in risk assets. A 50-bp increase in the 10-year yield will have similar economic effects as a two-point hike in the Fed Funs political business cycles becomeads rate.

If ATI is not unwound but becomes a permanently employed policy tool, we are likely to see higher equilibrium inflation and interest rates priced in over time due to political business cycles becoming reality.

Key Takes:

- Issuing more short-term bills reduces the supply of long-term bonds, pushing their price up and lowering their yield.

- This is similar to QE where the Fed buys bonds, reducing supply and lowering yields.

- Both manipulate the amount of interest rate risk investors hold, impacting the broader economy.

- This undermines the independence of FED and is a dangerous precedent for Political Reasons.

Amar Reganti

All is Normal

A Boring But Effective Strategy

Amar will argue that, the Office of Debt Management at the Treasury opts for a "boring" route—consistent, predictable, and designed to avoid market surprises.

He points that Unlike corporate issuers, who may time their debt issuance based on market conditions, the Treasury is always present across various points on the curve.

This consistency helps create a liquidity premium, ensuring that a broad and diversified group of investors can reliably participate in the market.

When making issuance decisions, the Treasury considers both quantitative and qualitative feedback from dealers, investors, and central bank reserve managers.

This comprehensive approach aims to maintain the health and liquidity of the Treasury market, even as it adjusts its strategy to current conditions.

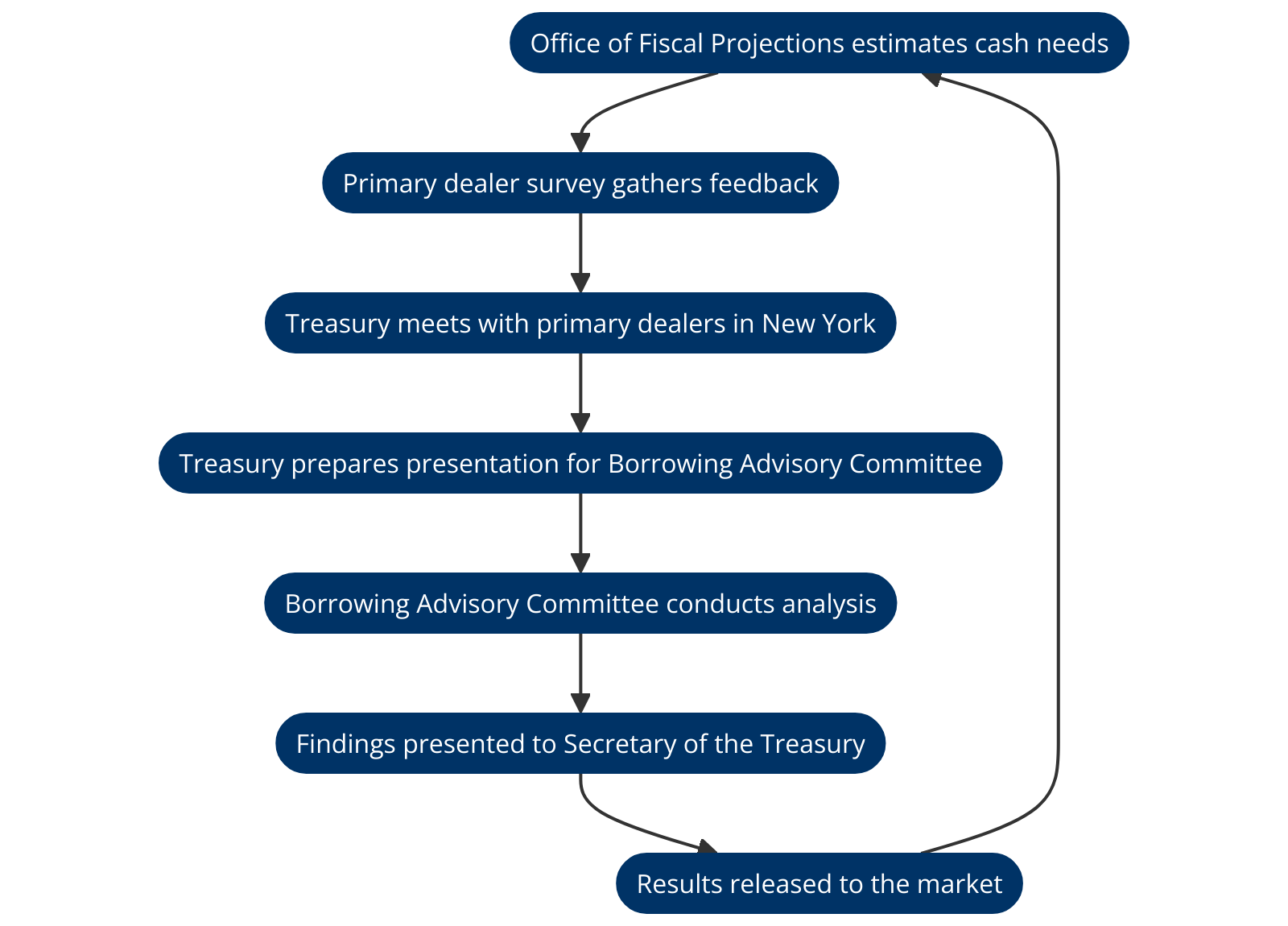

The Quarterly Refunding Process

Heres a Flow Chart For you to follow, this happens every Quarter:

Amar, also points out the difference between a Jay Powell Anouncements and the lattest QRA announcements, when hearing this came to mind:

Recent discussions have raised eyebrows on twitter over the Treasury's decision to temper the increase in longer-dated securities.

The rationale behind this move is to keep the wheels turning and liquidity flowing, serving the market by tapping into the areas where the largest pools of capital are asking for deb—that is, in the short term.

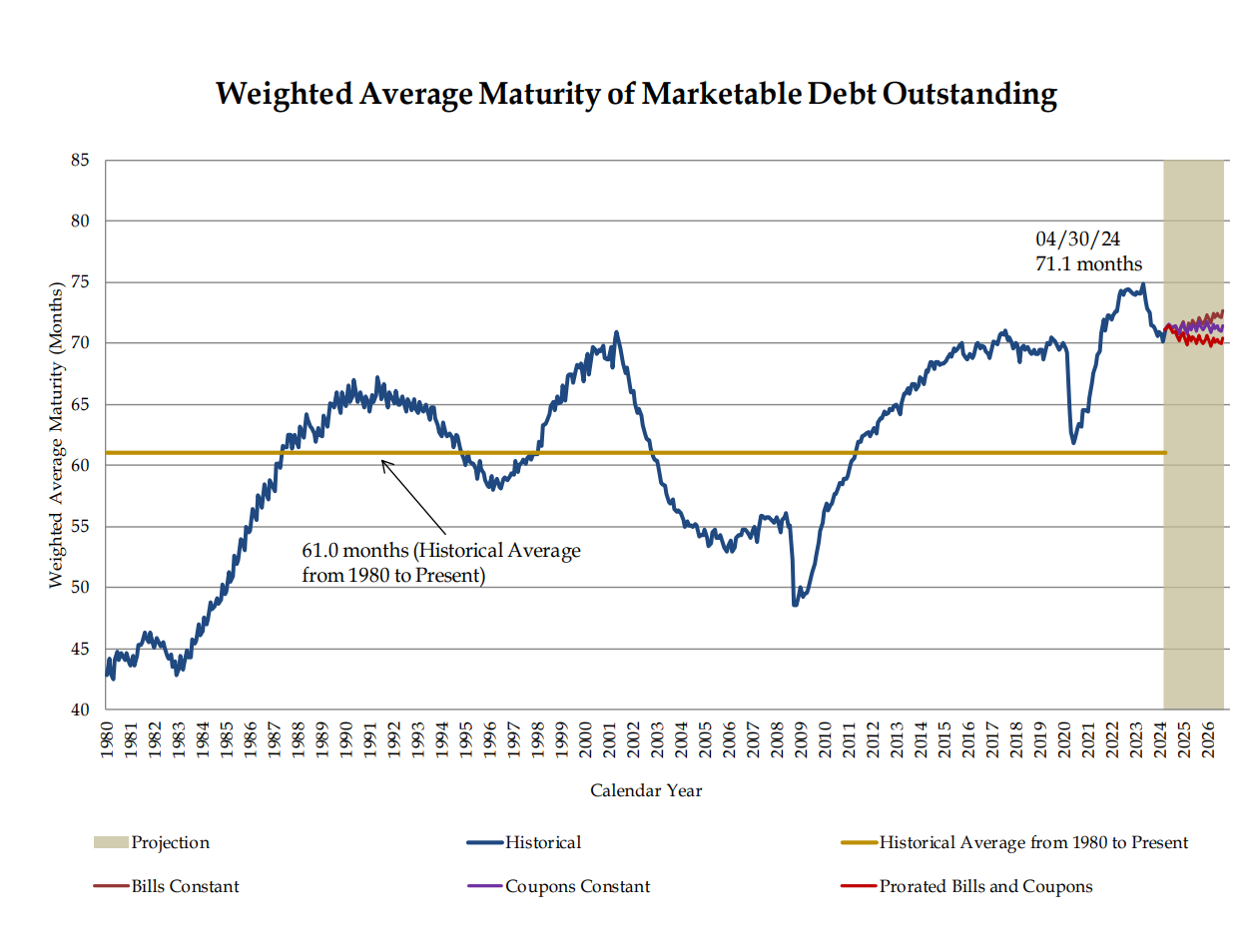

Also, While the weighted average maturity of outstanding debt (WAM) currently stands at around 71 months—slightly longer than historical averages—the Treasury has strategically issued more short-term debt to realign this average closer to the historical benchmark of 61 months

This approach aims to balance market stability with the flexibility to meet investor demand where it's strongest and Bills as a percent of Debt are AVG.

Interestingly, the Treasury he points out that the Treasury is not bound by rigid rules, and does not have a Target; here, everything is a rule of thumb. Its strategy is fluid, and historically, it has tried to adapt to market demands:

For example, floating-rate notes directly responded to market demand, illustrating the Treasury’s flexibility. However, not every new issuance is a success. The 20-year Treasury bond, for instance, has struggled with demand, largely due to path dependency and its relatively new status on the curve.

Key Takes:

- All is Normal; the Treasury Continues to fill its mandate of finding the best pools of capital to finance the US Debt.

- Maximizing Liquidity and a well function markets not based on rules is how the Treasury Operates.

- There is no Nick Timiraos of the QRA, Yet!

Plausible Deniability and the Future of Treasury Liquidity

We can now see, the difference in this fight comes from the right way to look at what normal debt issuance is Total WAM or Total Private WAMRR;

That said, in markets different from politics, we need to look at this situation as what is more likely to happen. There are valid arguments laid out, but what will happen in practice?

I have two takes of the implications from this debate:

The U.S. Treasury's recent shift toward issuing more short-term bills and fewer long-term bonds can be seen through the lens of "plausible deniability."

This allows the Treasury to argue that its actions are routine adjustments based on market demand rather than a deliberate attempt to influence economic outcomes, thereby avoiding Congress backlash and market backlash, outside of the well-written critique with valid arguments by Roubini and Mirin.

With all due respect, if Mirin were invited back to the treasury with a trump victory, would he term out the debt next year for the greater good?

Although unlikely, that would be interesting!

But again, we would never see the counterfactual to not terming out the debt.

BUYBACKS

Are they the new trend that will make Rolling ATI a Reality

Now, for the part that made me write this article, the authors highlighted another factor that caught my attention!

This year, a high frequency buyback program was introduced, in which the Treasury tested buying cheap off-the-run securities from the market every week, funded by new issuance.

For Now its very Small!

The program's goal is to improve liquidity and market functioning. Off-the-run securities become less liquid over the years that pass since their auctions and, as a result, trade at a discount in the market.

RV Rates Desks at macro, multi-strat, Relative-value HF Bread and Butter is to engage in relative value trades, where they buy the cheaper off-the-run Treasuries and short the more expensive on-the-run Treasuries.

And here's the size of the capital a couple of the platforms borrowed from prime brokers and the repo market, RV trades require massive leverage!

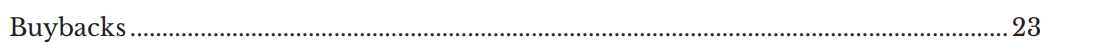

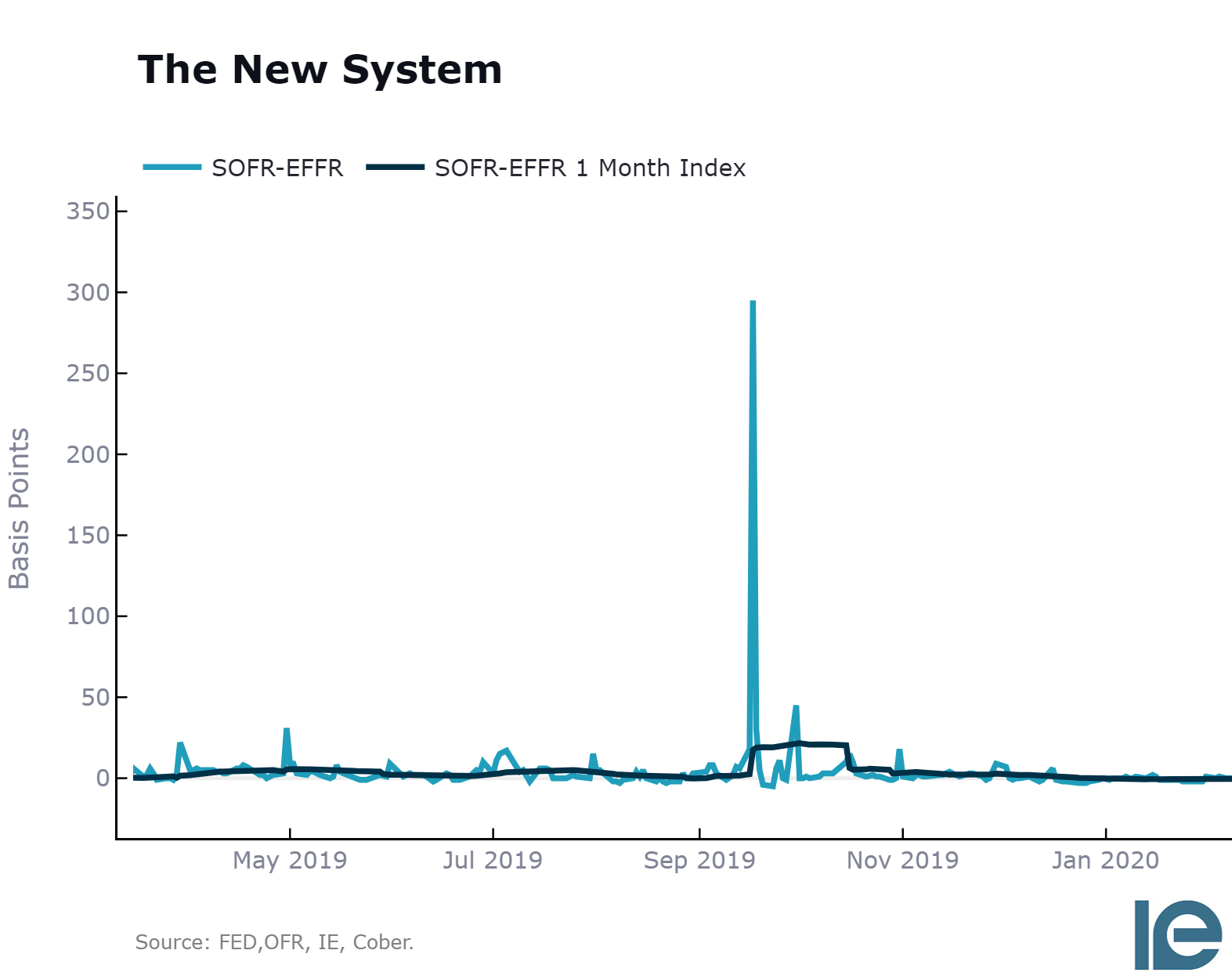

But we now officially live in the Secured Overnight Financing Rate world, where collateral matters even more than before,

There's no more LIBOR, and the Fed Funds markets have been dead for over ten Years.

It doesn't matter where you start in Fixed income.

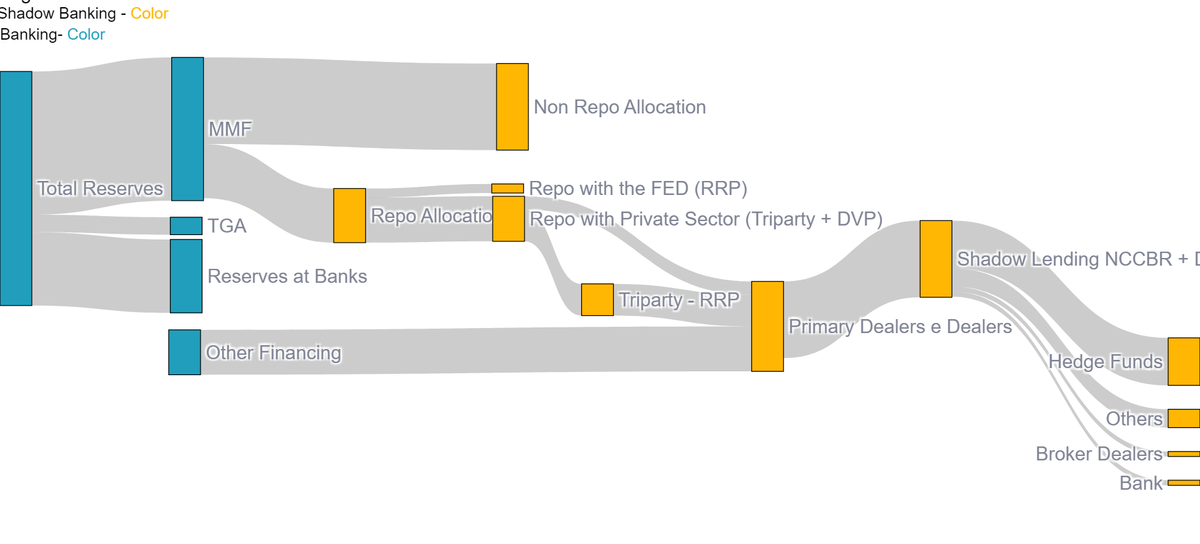

You always get to a common denominator, the Repo Market!

It looks like Treasury Buybacks are the Canary out of the coal mine of what's to come!

More Unconventional Macro Policy from the United States of America

The Post Pandemic Toolkit Grows:

- Standing Repo Facility (SRF)

- Amplified Acess to Reverse Repo Facility

- SOFR

- Centrally Cleared Treasuries Markets

- AIT (Average Inflation Target)

- high frequenvy BuyBacks?

Here is a list of opinions with top Market analysts, Policy Makers, and Academics who appeared on my favorite podcast, Macro Musings, to discuss Buybacks, Also note all of this interviews Happen After the September 2019 Repo Crash:

1. Impact on Liquidity and Market Functioning

- Yesha Yadav (2022-10-31) mentions that the Treasury Buyback Program can help improve liquidity in the Treasury market by swapping less liquid securities for more liquid ones. This increased liquidity can positively spillover effect on the repo market, which relies heavily on Treasuries as collateral. More liquid Treasuries can facilitate smoother repo transactions and reduce the risk of market disruptions.

2. Repo Market as a Financing Tool for Treasury Holdings

- Josh Galper (2019-12-23) explains that primary dealers use the repo market to finance their holdings of Treasury securities. When the Treasury conducts buybacks, it can alter the supply of specific maturities and types of Treasuries in the market. This, in turn, affects the collateral available for repo transactions. By managing the supply of Treasuries through buybacks, the Treasury can indirectly influence the repo market's dynamics.

3. Balancing Cash and Collateral

- George Selgin (2019-12-16) and Josh Galper (2019-12-23) both highlight the importance of balancing cash and collateral in the repo market. The Treasury Buyback Program can help manage this balance by adjusting the supply of Treasuries, thereby influencing the amount of collateral available for repo transactions. This can help stabilize repo rates and reduce volatility in the repo market.

4. Effect on Dealer Balance Sheets

- Darrell Duffie (2020-06-15) and Joshua Younger (2022-08-29) discuss how the repo market and Treasury holdings impact dealer balance sheets. The Treasury Buyback Program can help manage the maturity profile and liquidity of Treasuries, which can, in turn, affect the balance sheet capacity of dealers. By improving the liquidity of Treasuries, the buyback program can make it easier for dealers to manage their balance sheets and participate in the repo market.

5. Interaction with Central Bank Policies

- Lorie Logan (2022-01-10) and Bill Nelson (2023-04-10) mention the role of the Federal Reserve in providing liquidity through facilities like the Standing Repo Facility. The Treasury Buyback Program can complement these efforts by ensuring that the supply of Treasuries in the market is conducive to smooth repo operations. By managing the supply and liquidity of Treasuries, the buyback program can help reduce the need for central bank interventions in the repo market.

6. Addressing Market Stress and Volatility

- Jim Bianco (2019-12-09) and Matthew Raskin (2023-11-27) discuss how market stress and volatility can impact the repo market. The Treasury Buyback Program can help mitigate these issues by providing a mechanism to manage the supply of Treasuries and improve market liquidity. This can help reduce the likelihood of repo market disruptions and ensure more stable funding conditions.

Shout out to David Beckworth and the MacroMusing AI RAG for making this a breeze to fetch!

Conclusion

The Treasury Buyback Program interacts with the repo market by influencing the supply and liquidity of Treasuries, which are critical collateral for repo transactions.

That Said, its a valid point by Roubini and Miran, That this opens the door for maturity transformation by the FED Buying long end Issuing short end or other combinations, it the groundworks for more unconvencional policy.

The US will always do whats best to maximize liquidity in the debt market, that is the guideline, can one stop this is definitly a valid question!

With a Growing debt, we will need even more support, especially as the SEC sunsets the Noncentrally Cleared Bilateral Repo for Treasuries and The Rise of the Centrally Cleared Repo markets Begging!

Key Takeways:

- ATI Dynamics can have real impacts, but theres plausable deniability, The Treasury will always maxize liquidity, thats the name of the game play the cards you have.

- Curve traders will continue to be mad with Yellen this Quarter.

- A Emerging Toolbox of unconvencional policy is the New Normal.

- All Roads Lead to the Repo Market, the next couple of years will be a fun market to watch.

If you Read this Till The END You are Awesome, Share this with a friend and Good luck unwiding these are complex topics!

Writing helps me grasp a better understanding, hope reading my rumblings you learned something!

Here are two interactive free reports as a bonus!

Best,

MacroDispatch

Want to see a live View of Repo Markets:

Or the Lastes Charts of curated Independent FED Dual Mandate that updates Daily:

Member discussion